Trump sanctions impact: India eyes alternatives to Russian crude; imports oil from Guyana, Saudi Arabia but Russia still top supplier

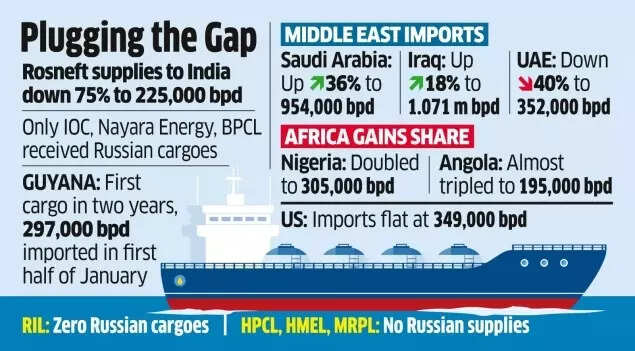

With supply of Russian crude hit due to US President Donald Trump’s sanctions, Indian refiners are looking at other sources of oil to fill the gap. Refiners are swiftly reshaping their crude sourcing strategy to offset reduced availability of Russian oil affected by US sanctions.While a more complete assessment of shifts in India’s crude import pattern will be available by the end of the month, preliminary figures indicate that refiners are increasingly drawing on new or previously minor suppliers to cover additional demand as Russian deliveries ease and uncertainty grows amid stronger US pressure. During the first half of January, only Indian Oil, Nayara Energy and Bharat Petroleum received Russian cargoes. Reliance Industries, which had been the largest buyer of Russian crude over the past year, did not import any during this period, nor did Hindustan Petroleum, HPCL-Mittal Energy, or Mangalore Refinery and Petrochemicals.

India Eyes Alternatives To Sanctioned Russian Crude Oil

Russia continues to be the country’s biggest source of crude, with inflows of around 1.179 million barrels per day in the first half of January. However, these volumes were about 3% lower than in the previous period and roughly 30% below the average seen in 2025. But diversification is happening.

Plugging the oil supply gap

For example; after a gap of two years, India’s refiners have lifted their first shipment from Guyana and have also stepped up purchases from Saudi Arabia by roughly one-third in January to cater to robust domestic fuel demand. As inflows from Russia taper off, Indian refiners are increasingly turning to Guyana to help fill the supply shortfall.Also Read | Trump’s 500% tariff pressure & global crude supply shock risks: Where does India’s oil security stand?Data from global analytics firm Kpler quoted in an ET report shows that during the first half of the month, refiners sourced around 297,000 barrels per day from Guyana. The South American country is fast gaining prominence as a major oil-producing nation, supported by significant discoveries and a sharp rise in output. Despite this growth, Guyana had earlier not featured prominently in India’s import mix because of the long transportation route involved.Crude purchases from West Asian producers such as Saudi Arabia and Iraq, along with shipments from African suppliers Nigeria and Angola, have increased this month as India’s oil consumption stays firm. India is the world’s third-largest user and importer of crude oil.According to Kpler, imports from Iraq, India’s second-largest supplier, climbed 18% on a month-on-month basis to nearly 1.071 million bpd, while purchases from Saudi Arabia surged 36% to approximately 954,000 bpd.Shipments from Nigeria almost doubled sequentially to about 305,000 bpd, and volumes from Angola rose nearly threefold to close to 195,000 bpd.In contrast, crude inflows from the UAE dropped sharply by 40% to roughly 352,000 bpd, while arrivals from the United States were largely unchanged at around 349,000 bpd during the first half of January.