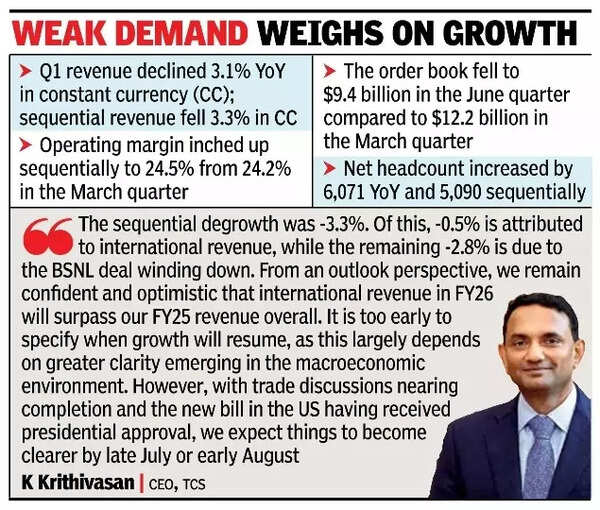

TCS Q1 revenue falls 3%, 1st drop in over 4 years

Bengaluru: TCS marked its first year-on-year decline in constant currency since the Sept quarter of FY21, with lacklustre performance attributed to weak macroeconomic conditions, cautious client sentiment, delayed decision-making, and the winding down of the BSNL deal. Its revenue for the June quarter fell 3.1% year-on-year in constant currency and 3.3% sequentially, as geopolitical uncertainties dampened demand.TCS CEO K Krithivasan said, “The sequential degrowth was -3.3%. Of this, -0.5% is attributed to international revenue, while the remaining -2.8% is due to the BSNL deal winding down. From an outlook perspective, we remain confident and optimistic that international revenue in FY26 will surpass our FY25 revenue overall. It is too early to specify when growth will resume, as this largely depends on greater clarity emerging in the macroeconomic environment. However, with trade discussions nearing completion and the new bill in the US having received presidential approval, we expect things to become clearer by late July or early August.”

Operating margin slipped slightly to 24.5% from 24.7% a year earlier. It, however, rose 30 basis points sequentially. “And the tailwinds came in from a reduction in third-party expenses,” said its CFO Samir Seksaria. Its mainstay market, North America, saw a 2.2% year-on-year decline in constant currency, while India reported a sharp 21.7% drop, largely due to the ramp-down of the BSNL deal.. The UK revenue fell by 1.3%, and Continental Europe declined by 3.1%.Krithivasan said the international revenue declined by 0.5%, driven by several factors. One key issue was clients with approved projects were pausing or delaying them, as the expected return on investment (ROI) is no longer immediate. The threshold for ROI has risen, causing more projects to be put on hold. “In some cases, decisions that we expected to be made within this quarter-so that transformation projects could start-have been delayed because clients are unclear about the return on investment for those projects. So, the overall reasons why projects are being delayed or paused remain very similar. However, as you can see, there was a minor-very small-growth in North America, while the UK and Europe experienced degrowth,” he added. When asked about the reasons behind the bearish commentary and demand contraction, Krithivasan said that consumer industries are more impacted by tariffs.