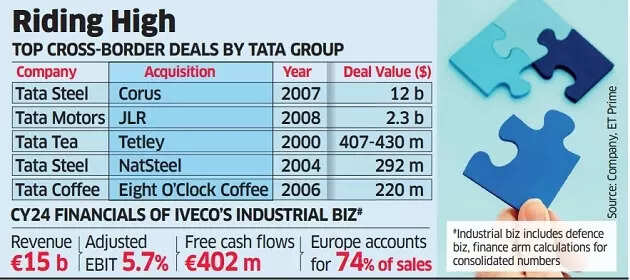

Tata Motors looks to buy Italian truck maker Iveco; deal likely at $4.5 billion – set to be Tata group’s second biggest acquisition

In its biggest acquisition ever, Tata Motors is preparing to acquire Italian truck manufacturer Iveco from the Agnelli family, its main shareholder, for $4.5 billion (3.9 billion). The last significant acquisition by Tata Motors was Jaguar Land Rover (JLR), purchased for $2.3 billion in 2008.This acquisition would become the Tata Group’s second-largest after Corus and the largest for its automotive division, sources familiar with the negotiations told ET.The sources revealed that both Tata Motors and Turin-based Iveco have scheduled board meetings on Wednesday to approve the deal.On Tuesday, Iveco confirmed it was engaged in “ongoing, advanced” discussions with various parties regarding two deals: one concerning its defence operations and another for the remainder of the organisation.

Riding High

Tata Motors Bets on Ivec

According to sources familiar with the proposed merger and acquisition structure who spoke to ET, Tata Motors plans to acquire 27.1% ownership from the Agnelli family’s investment firm Exor, which currently holds 43.1% voting rights. Subsequently, they will initiate a tender offer to acquire shares from smaller stakeholders.The defence division will not be included in the deal with Tata Motors.In May, Iveco had announced its intention to either divest or separate its defence operations by 2025’s end, noting that they had already received purchase proposals.On Tuesday, Iveco’s share price saw an increase of up to 7.4% during trading hours. The company’s market value has risen to $6.15 billion, representing more than a twofold increase this year.Tata and Iveco’s board, along with Exor, are supportive of the potential transaction, given the longstanding alliance between the Agnelli family and the group, particularly with former chairman Ratan Tata. The historical connection includes a previous joint venture between Tata and the Agnelli-owned Fiat Motors in India. The Agnelli family maintains significant investments in Ferrari and holds control of Stellantis, the Dutch automotive conglomerate that encompasses the Fiat brand.The transaction involves Morgan Stanley as Tata Motors’ advisor, whilst Goldman Sachs represents the Agnellis and Iveco. Clifford Chance provides legal counsel.“Discussions have been ongoing for the last one and a half months and have intensified in recent weeks,” said one of the sources cited above. “Both sides entered into an exclusivity agreement for bilateral negotiations. The exclusivity is due to lapse on August 1.”The proposed acquisition would be structured through a Dutch subsidiary, wholly owned by Tata Motors. The initial report of the Tata-Iveco negotiations appeared in Reuters on July 18.For Tata, this acquisition presents opportunities to enhance their commercial vehicle operations through access to advanced technology and expanded market presence. While Iveco generates 74% of its revenue from Europe, it maintains operations across North and Latin America.