Silver market jitters: ETFs see steep 20% drop; what’s causing the sudden drop?

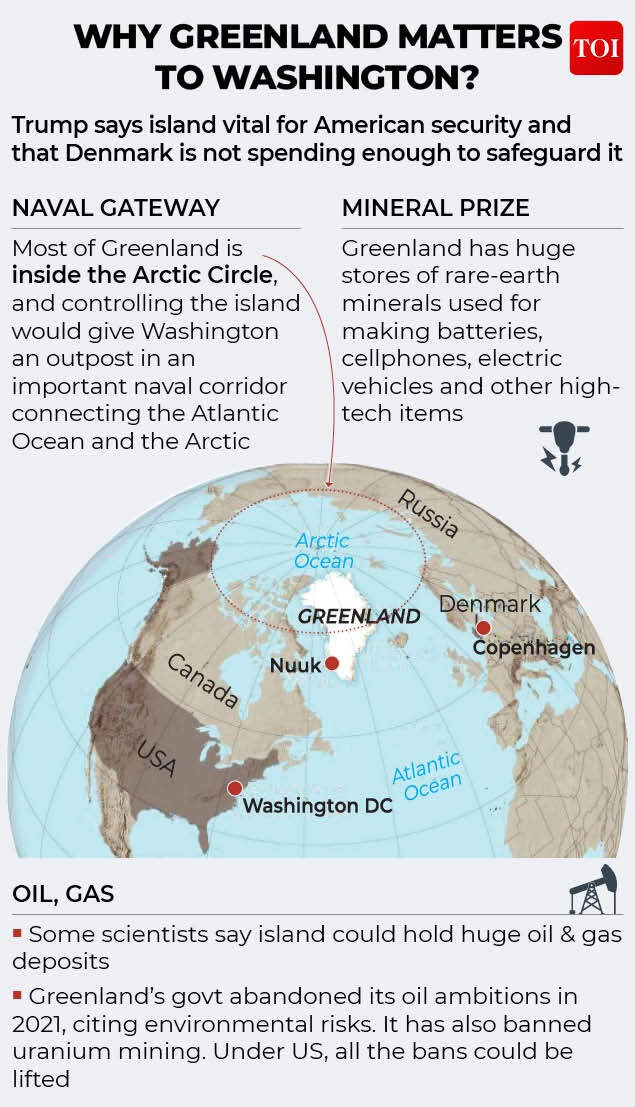

Indian silver exchange-traded funds (ETFs) witnessed a sharp sell-off on Thursday, plunging up to 20% in early trade as investors rushed to exit amid heightened volatility in precious metals. The steep fall wiped out the unusually high premium at which these ETFs were trading compared to international prices and physical silver markets.Nippon India Silver ETF, ICICI Prudential Silver ETF and Kotak Silver ETF fell between 19% and 20% during morning trade. As per ET, the funds slipped below their indicative net asset values (iNAVs), turning what was earlier a steep premium into a discount. The sell-off was largely limited to ETFs, highlighting the risks associated with sharp price dislocations in these products.In contrast, silver prices in other markets saw relatively modest declines. Global spot silver was trading around $92.27 an ounce, just days after touching a record high of $95.87 earlier this week.On the domestic front, MCX March silver futures slipped about 2% in morning trade, far less severe than the ETF correction.Market experts pointed to extreme volatility as a key factor behind the move. Manoj Kumar Jain of Prithvi Finmart said investors should avoid fresh positions in precious metals for now. “We are experiencing very high price volatility in both precious metals,” Jain was quoted as saying by ET, advising traders to wait for stability.The correction came as global risk appetite improved and the US dollar strengthened, reducing demand for safe-haven assets. Sentiment also eased after US President Donald Trump ruled out using military force over Greenland and signalled restraint on tariffs against European nations.Despite the turbulence, some analysts remain constructive on silver’s broader outlook. Ponmudi R, CEO of Enrich Money, said COMEX silver remains firm near $92–$93, supported by strong industrial demand and tight global supply. However, he cautioned that near-term swings could remain sharp, especially in ETF prices, given their tendency to trade at premiums or discounts during volatile phases.(Disclaimer: Recommendations and views on the stock market, other asset classes or personal finance management tips given by experts are their own. These opinions do not represent the views of The Times of India)