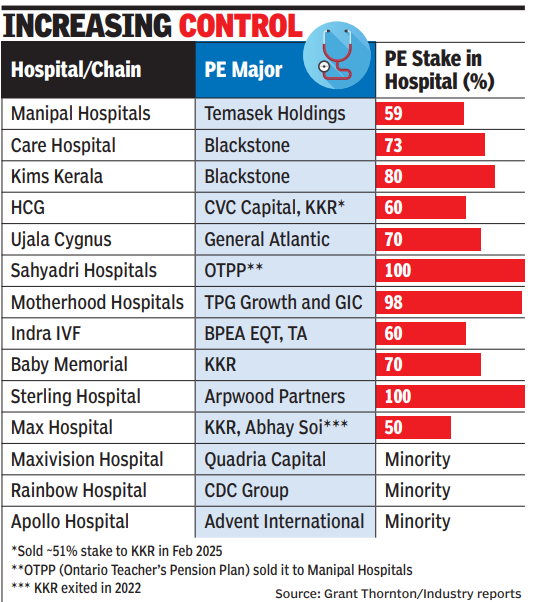

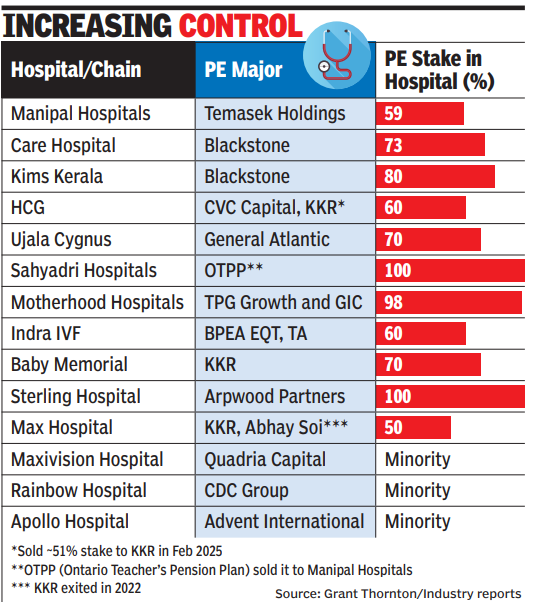

Private equity majors up stakes in private hospitals

“Private equity investments in healthcare typically follow a three-five year horizon, after which ownership often reverts to corporates or individuals. While private equity brings funds helping drive consolidation and provide last-mile financing, their investment horizons are usually too short to fully support long term asset-creation cycles that healthcare infrastructure demands,” Abhay Soi, CMD, Max Healthcare told TOI. In 2019, Soi, through his investment firm Radiant Life Care, partnered with KKR to acquire control of Max Healthcare, consolidated his holding after its promoter Analjit Singh’s exit, and remains the controlling shareholder even after KKR’s divestment. Earlier, hospitals in India were largely govt-run or family-owned, but today the landscape is dominated by private chains. The current trend mirrors the US, where hospitals are predominantly privately or institutionally owned. In contrast, hospitals are publicly run in the UK under the National Health Service. Says Sujay Shetty, global health industries advisory leader, PwC India: “Over the last five to six years, private equity ownership in hospitals has steadily increased. “The trend bodes well for an underserved market that continues to grapple with healthcare accessibility gaps, while also ensuring better access to capital, global best practices, and greater professionalisation.” Analysts are upbeat on the sector’s growth prospects. Longer life expectancy, rising incomes, lifestyle-linked non-communicable diseases, and greater health awareness have all fuelled demand, even as the country faces a severe shortage of hospital and critical-care beds. “Private equity participation brings growth capital, governance and operational expertise, enabling hospitals to improve service quality and expand their footprint. Healthcare has over 20 private equity operators active in India, which is the highest compared to any other sector,” says Bhanu Prakash Kalmath SJ, healthcare industry leader, Grant Thornton Bharat, said. Sunil Thakur, partner at Quadria Capital, says, “The ROIs of corporate hospital chains have improved over the last decade or so, primarily because of increasing utilisation, ARPOB and other cost efficiences.”