Old is gold as prices singe, rush for advance purchase

MUMBAI: Amid steep rise in gold prices, Indian consumers are going for exchanges-swapping old gold for new and are also advancing their purchases of wedding jewellery to avoid bearing the brunt of even higher rates given gold’s glittering rally amid geopolitical tensions. “Right now, people are concerned about rates spiralling even more although there has been some cooling off in the last few days or so. We have seen a significant jump in exchange-led sales,” said Arun Narayan, CEO, jewellery division at Titan Company. In fact, for Tanishq, close to half of its sales now have an element of exchange in it, Narayan who took over the CEO’s office in Jan following a long stint in the company, told TOI.

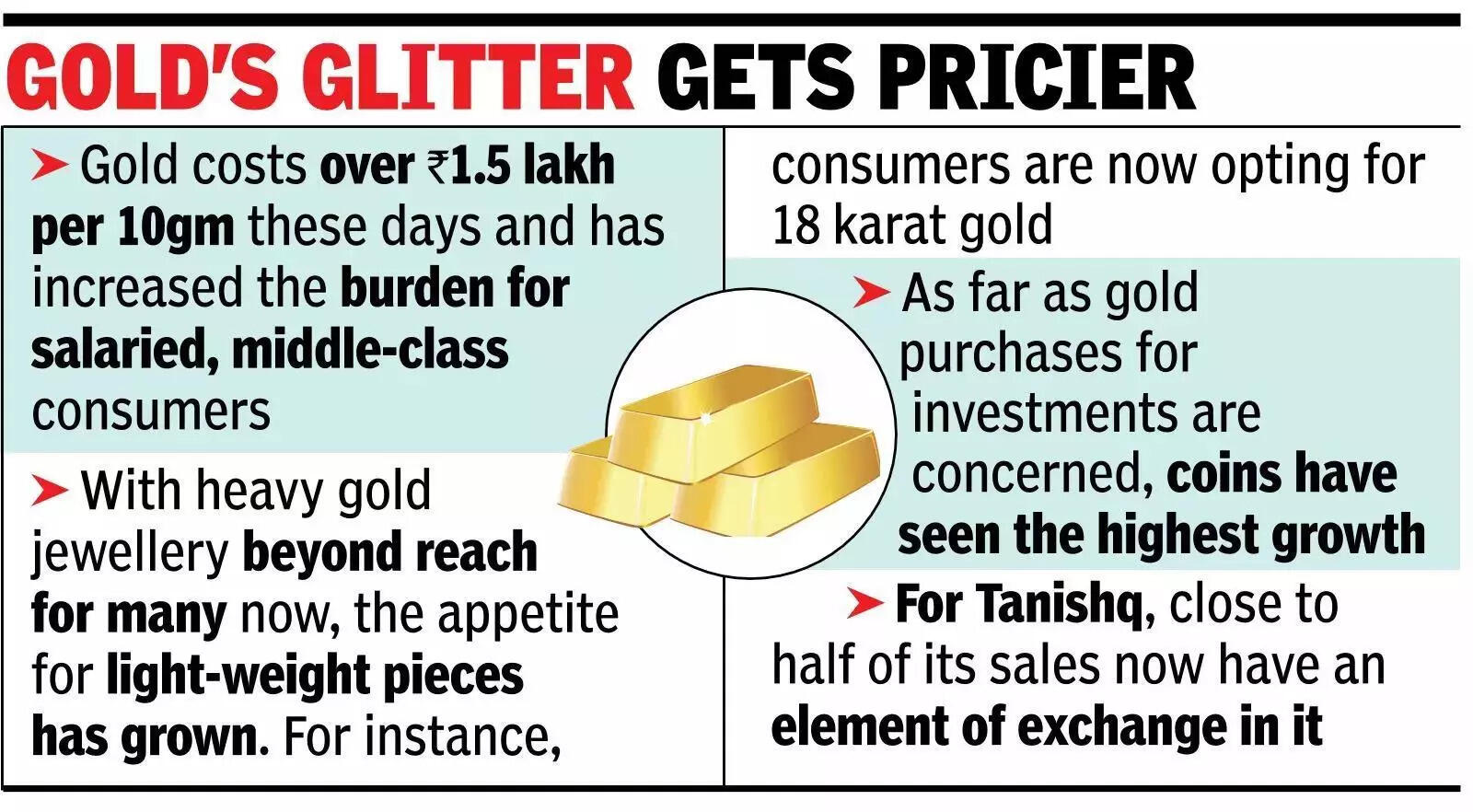

Prices of the yellow metal stood at close to Rs 1.5 lakh per 10 grams in spot market on Friday, having soared to as much as about Rs 1.8 lakh per 10 grams on Jan 29, increasing the cost burden for salaried, middle-class consumers. With heavy gold jewellery beyond reach for many now, the appetite for light-weight pieces has grown. In gold, for instance, consumers are now going for the 18 karat option. A similar trend is playing out in diamonds as well where 9 carat and 14 carat diamonds are gaining traction, Narayan said.

“Despite inflation (in gold prices), demand has stayed resilient because in our country, gold is seen as a storehouse of value. The confidence in gold has only grown with the rates going up,” Narayan said, projecting a good ongoing wedding season. As far as gold purchase for investment purposes is concerned, coins have seen the highest growth recently, Narayan said. Pushing for adoption of lab-grown diamondsHaving long shunned the idea of venturing into the lab-grown diamonds space, Titan recently forayed into the category with brand beYon, tactically positioning its first (and only one now) store in Mumbai opposite a Tanishq outlet. The strategy behind the move, Narayan said, is to push adoption and consumption of diamonds which is still very aspirational but as a category, has a mere 10%-12% penetration. The idea is to nudge consumers into diamond buying through lab-grown diamonds, eventually getting them to upgrade to natural diamonds, Narayan said. “beYon has the role to increase adoption and frequency (of buying). The pricing is the sweetest at beYon and we expect we can nurture that customer over time to Mia, CaratLane or Tanishq,” Narayan added. Lab-grown diamonds are priced significantly lower than natural diamonds, increasing their appeal. The segment is projected to account for about 16% of the global diamond market by 2029, up from nearly 12% in 2024, research firm Redseer said in a report last year.