Market breadth narrows: 60% of NSE 500 stocks still 20% below 2024 highs; analysts flag overvaluation, weak earnings outlook

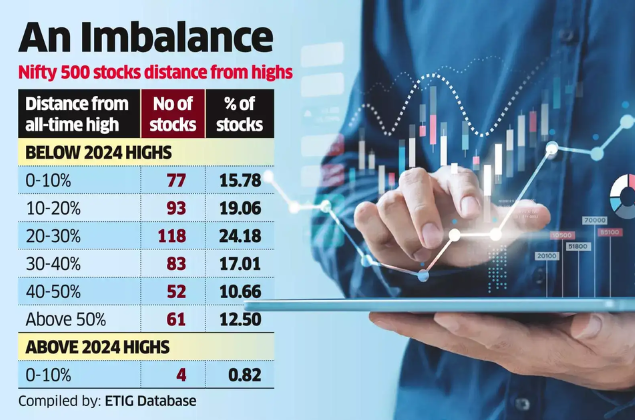

While benchmark indices like the Nifty 50 and Nifty 500 have rebounded and now sit 5–6% below their September 2024 record highs, a majority of the broader market continues to lag, with over 60% of NSE 500 stocks still trading more than 20% below their 2024 peaks, according to an ETIG study.The surge earlier in 2024 had lifted many stocks to lifetime highs, but since the September reversal of a four-year bull run, the rebound has been uneven. As per the analysis, 118 stocks in the Nifty 500 are 20–30% off their 2024 highs, 83 stocks are 30–40% below their peaks, and another 113 are trading more than 40% lower. In contrast, the Nifty 500 and Nifty 50 indices are 6.1% and 5.3% away from their respective highs.“This points to a narrow market rally, often driven by specific sectors or large-cap names,” Sudeep Shah, vice president and head of technical and derivative research at SBI Securities, told ET. He noted that the broader mid- and small-cap segments remain sluggish despite the overall index recovery.

Some of the worst-hit stocks include Jaiprakash Power Ventures, Network18 Media & Investments, Zee Entertainment Enterprises, Sammaan Capital, and Suzlon Energy, which are all down between 84% and 97% from their all-time highs. Others like Adani Total Gas, MMTC, Yes Bank, HFCL, and Vodafone Idea are also significantly off their peaks. Only four stocks—Laurus Labs, Fortis Healthcare, Shyam Metalics & Energy, and Torrent Pharmaceuticals—are trading above their 2024 highs.Despite these declines, elevated valuations persist in many segments. “Even a reasonably high growth company cannot be expected to deliver 35–40% growth to justify the valuations,” said Ashwini Shami, EVP and senior portfolio manager at OmniScience Capital. “The overvaluation is not over in the small and midcap stocks and these stocks are not expected to go back to the previous highs as that momentum was driven primarily by euphoria,” he told ET.Between September 2024 and February 2025, the Nifty 500 declined 18.8%, while the Nifty Mid-cap 150 and Small-cap 250 indices dropped 20.6% and 25%, respectively. Over the past three months, mid-cap and small-cap indices have recovered 9.2% and 12%, respectively, with the Nifty 500 gaining 5.3%.Investors have turned selective amid concerns over corporate profitability and tariff-related uncertainty. “Money is expected to flow to repriced pockets like the largecaps which are fairly priced, and within sectors, banks, housing finance companies, and financial services companies even in the mid and small-cap basket could offer investors a better bet,” said Shami. He added that infrastructure and power stocks also present opportunities, but investors must be cautious of elevated valuations.Shah pointed out that many midcaps and PSUs have surged more on sentiment, liquidity, and policy optimism than earnings. “The valuations in some pockets have turned reasonable but are still trading at a premium to their historical averages in others, especially in sectors such as consumer durables, FMCG, and select midcap IT names,” he said.(Disclaimer: Recommendations and views on the stock market and other asset classes given by experts are their own. These opinions do not represent the views of The Times of India)