India growth outlook: IMF lifts India’s 2025 growth forecast to 7.3%; stronger earnings, global resilience offset tariff shocks

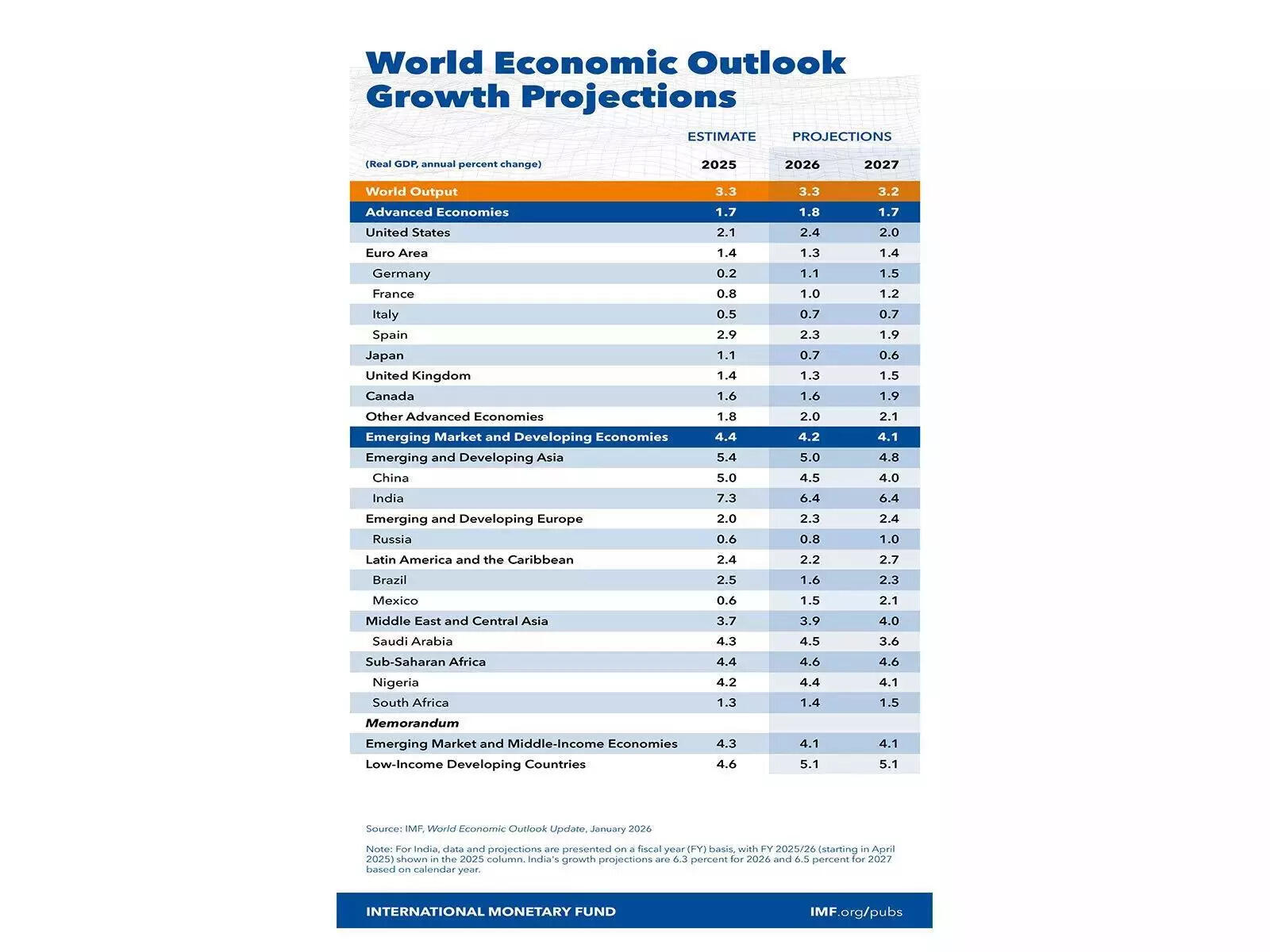

The International Monetary Fund (IMF) has raised India’s growth outlook for 2025 to 7.3 per cent, citing better-than-expected corporate earnings in the third quarter and strong momentum heading into the fourth, while also signalling that the global economy has largely absorbed the immediate impact of tariff-related shocks.In its latest World Economic Outlook, the IMF raised India’s 2025 growth projection by 0.7 percentage point to 7.3 per cent. Growth is, however, expected to ease to 6.4 per cent in 2026 and 2027, reflecting the softening of what it described as “cyclical and temporary factors”.

The revision comes after a period of stress last year, when a slowdown in corporate earnings growth emerged as a key factor behind economic and stock market volatility, triggering foreign fund outflows and investor caution. These pressures were compounded by persistent global trade tensions, elevated market valuations and concerns over India’s export performance following US tariff actions.

Indian economy to outperform global economy FY 2026 and 2027

The IMF estimates also projected 6.4 per cent in both 2026 and 2027, significantly outperforming global and advanced economy averages while world economy is projected to expand at 3.3 per cent in 2025 and 2026, before easing slightly to 3.2 per cent in 2027.

Compared to other major economies, India’s growth trajectory remains notably stronger: the United States is projected to grow at 2.4 per cent in 2026, China at 4.5 per cent, and the Euro Area at a modest 1.3 per cent.Among emerging and developing Asian economies, India continues to lead, outpacing regional peers and contributing significantly to Asia’s projected 5.0 per cent growth in 2026.The IMF said the recent improvement in corporate earnings is now providing a much-needed boost, signalling early signs of economic recovery. This strengthening profitability trend is expected to help restore investor confidence, support market stability and lay the foundation for renewed capital inflows, indicating the emergence of “green shoots” in India’s economic landscape.“Global economic growth continues to show notable resilience despite significant US-led trade disruptions and heightened uncertainty,” the IMF said in a blog accompanying the outlook. “Our latest projections indicate that global growth will hold steady at 3.3 per cent this year, an upward revision of 0.2 percentage points compared to October estimates, with most of the improvement accounted for by the United States and China.”IMF projected that global growth could rise by as much as 0.3 percentage points in 2026 and by 0.1 to 0.8 percentage points annually over the medium term, depending on the pace of artificial intelligence adoption and improvements in AI readiness worldwide.“While manufacturing activity remains subdued, IT investment as a share of US economic output has surged to the highest level since 2001, providing a major boost to overall business investment and activity,” the IMF said. It added that although this IT surge has been concentrated in the United States, it is also generating positive spillovers globally, particularly benefiting Asia’s technology exports.According to the Fund, companies worldwide stepped up capital investment in AI during the year, and this surge has been a key driver of the global economy’s resilience. Other supportive factors cited include easing trade tensions, higher-than-expected fiscal stimulus, accommodative financial conditions, the private sector’s agility in mitigating trade disruptions and improved policy frameworks, especially in emerging market economies.In the near term, the IMF said trade talks that have led to lower tariffs and improved policy predictability could enhance global efficiency gains. It reiterated that global growth is expected to remain at 3.3 per cent this year, 0.2 percentage point higher than earlier estimates, largely driven by the US and China.On prices, the IMF projected global headline inflation to decline from an estimated 4.1 per cent in 2025 to 3.8 per cent in 2026 and further to 3.4 per cent in 2027. India’s inflation, it said, is expected to move back towards target levels after a marked decline in 2025, driven mainly by subdued food prices.However, the Fund flagged several downside risks. It warned that risks around AI-sector earnings growth amid lofty valuations could sour investor sentiment. A sharp correction in US equities after decades of rising foreign ownership could result in significant wealth losses abroad, dampen global consumption and hurt even low-tech, high-debt and low-income countries through weaker demand and higher borrowing costs.The IMF also cautioned that escalating trade, domestic or geopolitical tensions, coupled with large fiscal deficits and high public debt, could prolong global uncertainty, disrupt financial markets, supply chains and commodity prices, and put upward pressure on interest rates, weighing on economic activity worldwide.