In just 5 years, Tata Group’s semiconductor business becomes a major revenue source

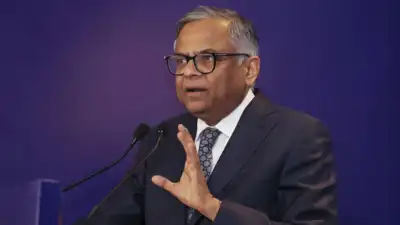

MUMBAI: The Tata Group’s semiconductor manufacturing business has emerged as a significant revenue generator within just five years of its inception, ranking as the sixth-largest contributor despite some losses.Tata Electronics, which began operations in 2020, recorded Rs 66,601 crore revenue in FY25, with a small loss of Rs 70 crore. The modest deficit indicates it has good potential to turn profitable soon. The company grew through strategic buys, such as the Rs 1,078-crore purchase of Wistron India in 2024 and a Rs 1,650-crore investment for a 60% stake in Pegatron India in 2025.N Chandrasekaran, who heads Tata Sons, the principal entity of the $180 billion Tata Group, shared in a letter to the company’s shareholders, “Tata Electronics is well on the road. It already employs over 65,000 workforce (of which about 70% are women) and has an annual revenue of Rs 66,000 crore. In the capital-intensive world of technology hardware, I am told this is a good start.” The company’s workforce makes it the fourth biggest employer within the nearly 160-year-old conglomerate.Chandrasekaran also mentioned that Tata Electronics started its chip journey with the reliable 28nm node. The advancement towards sophisticated chip manufacturing will stem from this foundation, he said, noting that “It will take several years of serious work”. Tata Sons infused an additional Rs 3,000 crore in Tata Electronics to finance its growth, the principal entity’s FY25 report revealed.The aviation business, also a recent addition to the group’s portfolio, contributed Rs 78,636 crore to overall revenues, landing fourth among the 31 listed and unlisted companies. However, Air India, acquired by Tata Sons in 2021, lost Rs 10,859 crore in FY25, making it the largest loss-making entity in the group. Tata Sons invested another Rs 3,225 crore in Air India that fiscal year to strengthen its balance sheet. Tata Digital, established five years ago and grew by buying Bigbasket and 1mg, registered the second-highest loss, amounting to Rs 4,610 crore. The company, which runs the Tata Neu super app, made Rs 32,188 crore in revenue, ranking as the ninth contributor.In FY25, Tata Sons infused Rs 3,000 crore more in Tata Digital, which employs 39,088 people. Its workforce makes Tata Digital the fifth-largest employer after Tata Electronics. Tata Steel, Tata Motors, and TCS hold the top three spots with 79,435, 86,259, and 607,979 employees each.Besides electronics, aviation, and digital retail, the group has new businesses in battery manufacturing and telecom technologies. Agratas, established in 2023, is constructing two battery gigafactories in India and the UK with a consolidated capacity of 60 GWh. Tejas Networks, bought by Tata Sons in 2021, generated Rs 8,969 crore in revenue and made Rs 447 crore in profit in FY25.The group started new businesses based on mega global and Indian trends, Tata Sons said in its FY25 report. It knew old strategies would not work over time and in changing economic conditions. Chandrasekaran said, “The Tata Group has been on a transformational journey towards financial and strategic fitness. We must be fit to perform. Some decisions that might have appeared ideal when they were taken may have aged poorly with time and changing economic conditions. Our mantra in the last few years has been “fitness first, velocity next”.”TCS led the group’s profits with Rs 48,797 crore, followed by Tata Motors with Rs 28,149 crore, Tata Sons with Rs 26,232 crore, and Tata Power with Rs 4,775 crore. Overall, the Tata Group made Rs 1.13 lakh crore in profit in FY25.