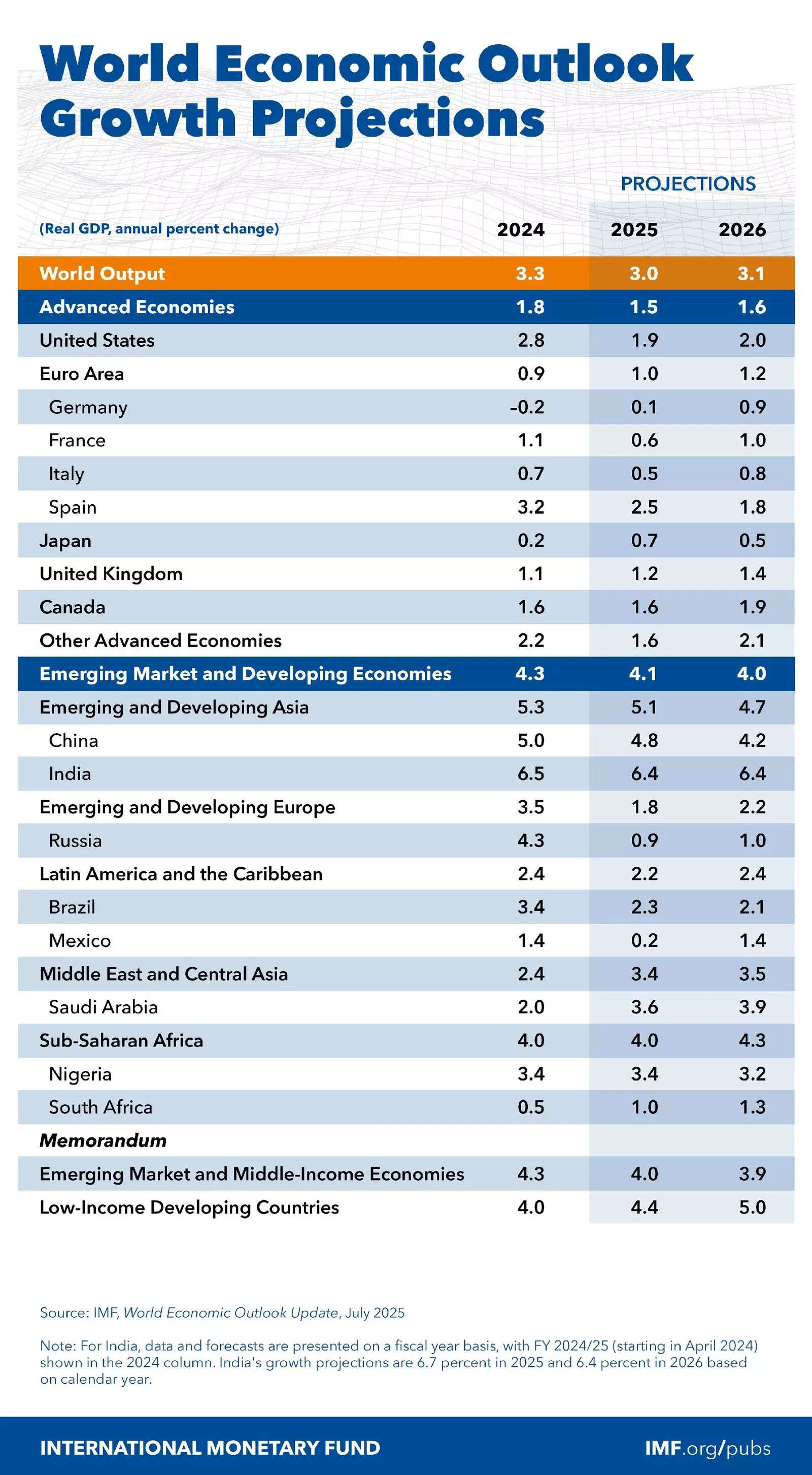

Donald Trump’s tariffs to hit less than expected! IMF raises global growth forecast to 3% for 2025; India, US, China see upgrades

The International Monetary Fund (IMF) on Tuesday upgraded its global growth outlook for 2025, projecting a 3% expansion—up 0.2 percentage points from its April forecast—as early stockpiling ahead of US tariffs, a weaker dollar, and improved financial conditions help cushion the blow of American President Donald Trump’s sweeping trade measures.Growth for 2026 was also raised marginally to 3.1%, according to the IMF’s July update of the World Economic Outlook (WEO). “This reflects stronger-than-expected front-loading in anticipation of higher tariffs; lower average effective US tariff rates than announced in April; an improvement in financial conditions, including due to a weaker US dollar; and fiscal expansion in some major jurisdictions,” the IMF said.US, China, India growth forecast raisedThe US economy is now expected to grow 1.9% in 2025 and 2% in 2026, bolstered in part by fiscal expansion, including the effects of Trump’s tax cuts. China’s forecast was revised up sharply to 4.8%, from 4% earlier, on the back of lower-than-expected US tariffs and higher public spending. India will likely retain its crown as the world’s fastest-growing major economy, with projected growth of 6.4% in both 2025 and 2026, up 0.2% from the previous April estimates.

Euro area growth is now seen at 1% in 2025, up from 0.8%, led by a surge in pharmaceutical exports from Ireland ahead of new US drug tariffs. Japan continues to lag with sub-1% growth expectations.Global inflation seen easing, but US could remain above targetIMF expects global headline inflation to decline to 4.2% in 2025 and further to 3.6% in 2026, broadly in line with its April estimates. However, the IMF warned of diverging trends. “The overall picture hides notable cross-country differences, with forecasts predicting inflation will remain above target in the United States and be more subdued in other large economies.”IMF flags downside risks if trade shocks worsenWhile the tone of the update was cautiously optimistic, the IMF flagged significant risks to the outlook. “Risks to the outlook are tilted to the downside, as they were in the April 2025 WEO,” the report noted.“A rebound in effective tariff rates could lead to weaker growth. Elevated uncertainty could start weighing more heavily on activity, also as deadlines for additional tariffs expire without progress on substantial, permanent agreements,” the IMF said, warning that geopolitical tensions may disrupt global supply chains and fuel commodity price spikes.Markets, central banks in spotlightThe IMF cautioned that rising fiscal deficits or greater risk aversion could lift long-term interest rates and trigger financial volatility. “Combined with fragmentation concerns, this could reignite volatility in financial markets,” it said.On the other hand, progress on the trade front could deliver upside surprises: “Global growth could be lifted if trade negotiations lead to a predictable framework and to a decline in tariffs,” the IMF said.Calling for a coordinated global policy response, the Fund urged governments to ensure “confidence, predictability, and sustainability by calming tensions, preserving price and financial stability, restoring fiscal buffers, and implementing much-needed structural reforms.”