Budget 2026: What the past five years say about this year’s priorities

Each year, the Union Budget draws the nation’s attention as it defines the country’s economic direction for the new financial year. As Finance Minister wields the fiscal scalpel, focussed on tax rates, rebalancing expenditure, and setting priorities, every Indian household, business and policymaker watches keenly to understand what they will gain or lose.Past budgets have marked significant personal income tax relief, which included raising the exemption limit to incentivise consumption. Capital expenditure has consistently risen, marking the importance of infrastructure and connectivity as engines of growth.Looking at Budget 2026, to be presented on February 1, expectations would be that it would be yet another opportunity to deepen reforms by pushing manufacturing competitiveness, improving human capital, modernising tax and trade regimes, and reinforcing investment in emerging technologies that will lay out a roadmap for resilient, inclusive, and innovation-led growth.Here is a quick rundown of the key changes that have been seen in the past 5 years and what is the scope for FY 2026-27.

Tax reforms

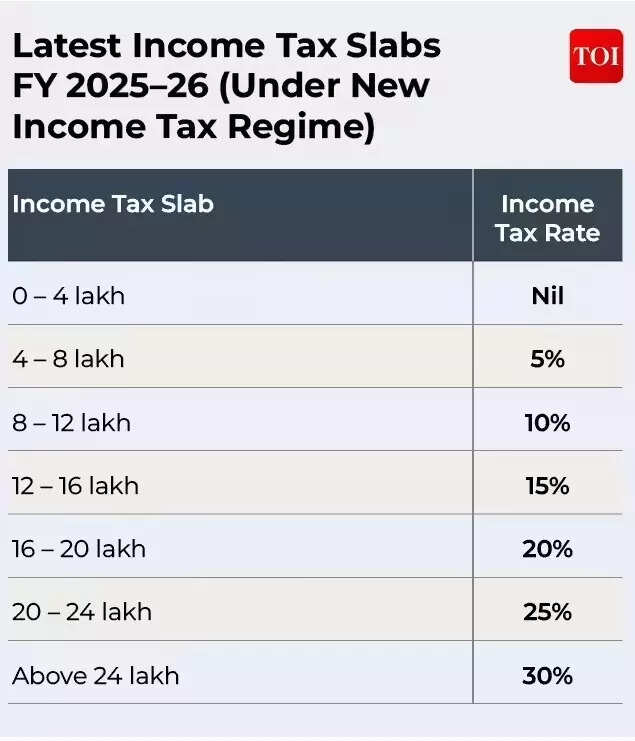

Over the last five budgets, FY 2021-22 through FY 2025-26, India’s tax landscape has been shaped by progressive personal tax restructuring, targeted corporate tax continuity, and evolving indirect tax policy. In the earlier part of this period, the new income tax regime introduced in the 2020 Union Budget continued to evolve. While Budgets 2021 and 2022 left core slabs largely unchanged, Budget 2023 made the new tax regime the default choice on the income-tax e-filing portal and enhanced its structure with fewer slabs, a higher basic exemption and a standard deduction to benefit individual taxpayers. Budget 2024 further sweetened relief for salaried employees with the standard deduction for salaried individuals under the new regime raised to Rs 75,000/- from Rs 50,000.Next year, Budget 2025 saw one of the most significant tax reforms to date. Personal income tax up to Rs 12 lakh was made fully exempt under the new regime (meaning Rs 12.75 lakh for salaried taxpayers after standard deduction), with restructured slabs above that threshold, substantially lowering the direct tax burden for the middle class.

As for indirect taxes, GST (Goods and Services Tax), first introduced in 2017, also had some changes. The most significant reform came last year, when the GST rate structure was simplified from multiple slabs to a two-tier system of 5 per cent and 18 per cent, along with a 40 per cent levy on select luxury or “sin” goods. Although not part of the Budget presentation, it was a move aimed at reducing complexity and easing the tax burden for both consumers and businesses and will surely be a factor setting the tone for the upcoming Budget. Looking toward Budget 2026, expectations remain on refinements to the tax regime and compliance ease, such as fewer income tax slabs under the new regime and further indirect tax rationalisation, rather than broad rate reductions, as fiscal space is balanced against growth priorities.Speaking on the tax reforms and scope in the upcoming budget, Sanjiv Malhotra, senior advisor – Head of Tax Practice at Shardul Amarchand Mangaldas, talked to TOI and put light on the reality of the GST reforms and what he believes the government needs to do now. “Post pandemic India has experienced robust tax collections (both for direct and indirect taxes) and with a bullish GDP growth expectation for FY 2026, Government should have been able to make ample fiscal space without compromising too much on the fiscal deficit targets. FY 2025-26, however, is witnessing weaker tax collections both on income tax and GST,” he said.Further talking about the hit to government revenue, Malhotra added, “GST rationalisation in 2025 has hit the Government’s wallet hard and the same does not seem to have been off-set by stronger direct tax collections. Thus, the fiscal space seems to be limited. However, creative reallocation of funds can always create room for additional spendings in identified priority sectors.”Meanwhile, Sumit Singhania, Partner, Deloitte India also talked to TOI about real impact on tax collections but had an optimistic outlook. “The fiscal deficit target for FY26 was pegged at 4.4 percent in Budget 2025. Going by quarterly macro data, this target looks within the reach. Direct tax collections for the current fiscal is showing strong momentum 8%y-o-y growth YTD) even as GST collections growth may be subdued owing to a recent set of structural reforms. That said, overall tax and non-tax revenues growth is indeed encouraging and will help the government’s fiscal consolidation target on track. It’s quite likely that the fiscal deficit target for FY27 could be between 4.1 and 4.3 percent,” he said. He further talked about the scope for changes that he believes exist.

Infrastructure and capital expenditure

Over the past five Union Budgets, infrastructure-led capital expenditure has moved from a counter-cyclical recovery tool to a significant piece in India’s growth strategy. Central capex allocation rose sharply from about Rs 5.54 lakh crore in FY 2021-22 to Rs 7.5 lakh crore in FY 2022-23, before crossing the Rs 10 lakh crore mark in FY 2023-24, a jump of nearly 37 per cent year-on-year. The interim FY 2024-25 Budget sustained this trajectory at around Rs 11.1 lakh crore, and FY 2025-26 pushed it further to roughly Rs 11.2 lakh crore, equivalent to just over 3 per cent of GDP. A large share of this outlay has consistently flowed into transport infrastructure, particularly roads and railways. Railways, in particular, show the long-term impact of sustained capex. With annual capital support rising to about Rs 2.6 lakh crore in recent budgets, a decade-long investment cycle has delivered visible system upgrades, including the rollout of more than 160 Vande Bharat trains and new Amrit Bharat services, rapid electrification of over 99 per cent of the broad-gauge network, and the phased deployment of the Kavach automatic train protection system to improve safety. Capacity augmentation, track renewal and station redevelopment have progressed alongside fleet expansion, with thousands of new coaches planned over FY 2025-26 and FY 2026-27.Another key part of capex and infrastructure growth is roads and highways. Since FY 2021-22, allocation for roads and highways has grown sharply. In that year, the Ministry of Road Transport and Highways’ total expenditure was modest compared with later levels, but by FY 2022-23, capital support had jumped significantly, largely driven by a steep increase in capital expenditure for national highways. In FY 2023-24, the ministry’s budget allocation was around Rs 2.7 lakh crore, up by roughly 36 per cent from the previous year, with the National Highways Authority of India receiving around Rs 1.62 lakh crore for expanding and upgrading the network. The interim FY 2024-25 budget maintained this, allocating approximately Rs 2.78 lakh crore to the sector, while FY 2025-26 continued at similar levels around Rs 2.87 lakh crore, even as commitments shifted toward new project awards and expressway development. These sustained allocations have supported expansion of the national highway network, increased daily construction targets and major corridor projects.The key policy question ahead of Budget 2026 is fiscal sustainability. Although capital expenditure has remained high even as the fiscal deficit is steered lower, sustaining double-digit growth in outlays could prove difficult if tax revenues soften. The emphasis may therefore shift from rapid expansion to better asset utilisation, safety improvements and timely completion of ongoing projects, ensuring earlier investments translate into productivity gains without overstretching public finances.In this context, Budget 2026 could prioritise faster execution over simply higher allocations. The government may also present a clearer roadmap for asset monetisation to mobilise resources without widening the deficit. Industry groups such as the Confederation of Indian Industry have proposed a National Infrastructure Guarantee Corporation to enhance investor confidence, reduce financing costs and unlock stalled infrastructure projects.Talking about possible changes to Railways and infrastructure and what other sectors could have increased allocation, Anurag Gupta, Partner, Deloitte India told TOI, “While the growing trend in budgetary support is expected to continue in Budget 2026, greater reliance on PPPs would be critical to meet the ambitious investments goals laid out over next 10 years by IR. Apart from Railways, we expect growth across social infra sectors like water and sanitation. Lastly, capacity creation must also be complemented with seamless infrastructure service delivery and quality of infrastructure.”

Defence

In the past few years, defence budget allocations have risen steadily, even as broader fiscal pressures have shaped allocations. In FY 2021-22, the defence budget hike was modest amid pandemic pressures, but it grew in FY 2022-23 to around Rs 5.25 lakh crore as the government prioritised operational readiness and modernisation. Meanwhile the allocations for FY 2023-24 was increased to around Rs 5.94 lakh crore, showing continued growth in investments in equipment as well as force development. The FY 2024-25 budget further raised the defence allocation to nearly Rs 6.22 lakh crore, making defence the second-largest ministry allocation and boosting capital outlay for modernisation and domestic procurement under the self-reliance agenda. In the FY 2025-26, the defence budget stood at a high of 6.81 lakh crore rupees, which signified a rise of nearly 9.5 percent compared to the budget figure of the previous year, with nearly 1.80 lakh crore rupees earmarked for buying newer defence equipment like aircraft, ships, etc.Throughout this period, revenue expenditure on salaries, maintenance and pensions has continued to account for a large share of the total, even as capital allocations emphasise modernisation and indigenous procurement under initiatives such as Make in India. The rising budget and sustained support for domestic defence production have coincided with record increases in defence production and exports, showing a shift toward self-reliance in military hardware.For Budget 2026, defence spending is expected to prioritise military preparedness and modernisation, in the backdrop of Operation Sindoor in May 2025. According to FICCI’s pre-Budget recommendations, India’s heightened external security environment and advances by adversaries in AI-enabled warfare, hypersonic systems, UAV swarms, and multi-domain operations make a strong, modern, and well-resourced defence architecture a strategic imperative. The industry body suggests increasing capital outlay to 30 per cent of the defence budget from 26 per cent, boosting frontline assets, UAVs, electronic warfare systems, and border air-defence capabilities, while also raising the DRDO allocation by Rs 10,000 crore to support frontier technologies, private sector collaboration, and deep-tech innovation.FICCI also mentioned indigenisation under Atmanirbhar Bharat, recommending expansion of Defence Industrial Corridors, including a proposed Eastern India corridor, to spur R&D, job creation, and global defence exports, which have grown at a CAGR of 46 per cent between 2016–17 and 2023–24. Establishing a Defence Export Promotion Council was also suggested to coordinate among DPSUs, private manufacturers, and foreign buyers, helping India reach its target of Rs 50,000 crore in exports by 2028–29.

Make in India / Manufacturing

Over the past budgets, support for manufacturing under the Make in India agenda has increasingly centred on Production-Linked Incentive (PLI) schemes and allied incentives aimed at boosting domestic production, investment and exports. PLI was introduced in the Budget for the first time in 2021 (after launch in 2020) with Rs 1.97 lakh crore allocation across 13 sectors.As of August-2025, 806 PLI applications have been approved across different sectors. Actual investments of around Rs 1.76 lakh crore have been realised and incremental production and sales are estimated at over Rs 16.5 lakh crore, generating more than 12 lakh jobs (direct and indirect). Incentives of Rs 21,500 crore approx. have been disbursed so far, aiding medical devices, pharmaceuticals and electronics expand capacity and exports, even as some sub-programmes face delays in payouts or delivery. Certain PLI initiatives, such as high-efficiency solar and advanced battery cells, have seen slower uptake so far, illustrating that outcomes vary significantly by sector. Overall, the PLI framework has strengthened manufacturing activity and global competitiveness, particularly in mobile and bulk drugs, though visible returns depend on sector readiness, compliance timelines, and efficient incentive disbursement, setting the stage for refinements in support as Budget 2026 approaches.Subsidies: Food, fertiliser and fuelOver the past five budgets, India’s welfare and subsidy allocations, particularly for food, fertiliser and fuel have been sharply recalibrated from the pandemic peak to more normalised levels. In FY 2021‑22, food and fertiliser subsidies remained elevated under pandemic relief measures, including free grains under PMGKAY, keeping the combined subsidy bill above pre-pandemic levels. Then, according to the Budget documents, total subsidies on food, fertilisers and petroleum were pegged at Rs 5,21,585 crore in the revised estimates for 2022–23, up from Rs 4,46,149 crore in the previous year. Food subsidy saw a marginal dip to Rs 2,87,194 crore from Rs 2,88,969 crore. In contrast, fertiliser subsidy surged to Rs 2,25,220 crore from Rs 1,53,758 crore, driven by higher support for both urea and phosphatic & potassic (P&K) nutrients. Petroleum subsidy also increased, rising to Rs 9,171 crore from Rs 3,423 crore.For the following fiscal year, total subsidies on food, fertilisers and petroleum were projected to decline by 28 per cent to Rs 3,74,707 crore, down from Rs 5,21,585 crore in 2022–23. Fertiliser subsidy was estimated to fall to Rs 1,75,100 crore from Rs 2,25,220 crore, while petroleum subsidy was expected to drop sharply to Rs 2,257 crore from Rs 9,171 crore. Food subsidy was also expected to have a reduction to Rs 1,97,350 crore, compared with Rs 2,87,194 crore a year earlier, following the discontinuation of the pandemic-era free foodgrain scheme.The interim FY 2024‑25 Budget allocated about Rs 4.09 lakh crore, with slight declines in fertiliser subsidies, while FY 2025‑26 saw total subsidies at roughly Rs 4.26 lakh crore, with food at Rs 2.03 lakh crore and fertiliser at Rs 1.67 lakh crore.For Budget 2026, subsidy provisions are expected to remain focused on targeted welfare delivery and efficiency rather than large expansions. With pandemic-time emergency relief measures mostly withdrawn, allocations may centre on the Public Distribution System, fertiliser support aligned with global price trends, and existing LPG or clean energy subsidy frameworks.

Agriculture

Over the past five budgets, agriculture and rural development have been seen as fiscal priorities, FM Nirmala Sitharaman calling it the “first engine” of the country’s development during the 2025-26 budget presentation. In Budget 2021-22 foundational schemes such as the Agriculture Infrastructure Fund, expanded e-NAM mandis and micro-irrigation support were emphasised upon amid pandemic recovery. By Budget 2023-24, the government had increased allocations for the agriculture ministry to roughly Rs 1.25 lakh crore, including significant releases under PM-Kisan Samman Nidhi with more than Rs 2.8 lakh crore disbursed to over 11 crore farmers via direct benefit transfer. This year also saw higher spending on rural employment and insurance outlays to stabilise farm incomes.Subsequently, in the budget of FY 2024-25, the aggregate allocations funded to the agriculture and allied areas increased by an additional 4.5 per cent to Rs 1.40 lakh crores, with the latter registering double-digit growth. Similarly, the budget of 2025-26 proposed an allocation of about Rs 1.37 lakh crores and launching missions like rural prosperity, underemployment, skilling, and self-reliance.Throughout this period, rural safety nets such as MGNREGA remained stable, supporting work on rural infrastructure that increasingly benefited agricultural productivity, as evidenced by rising utilisation of funds for land development, irrigation and water harvesting.Looking into the expectations from Budget 2026, it would include the continued income support, raising the limit of subsidised credit (e.g., raising the limit on Kisan credit cards), building on the productivity and value chain missions, and a stronger impetus to rural resilience and employment generation to fuel growth in the agrarian economy.

What can we hope for in 2026?

Based on the past budgets, there is a pattern emerging: a rise in capital expenditure, providing relief to the taxpayers, supporting the manufacturing sector, and providing impetus to welfare measures, all with the aim of cutting the fiscal deficit. Budget 2026 is likely to be a repeat performance of the above balancing act, as the economy is witnessing a pick-up in infrastructure, defence, and manufacturing sectors along with a fine-tuning of subsidies and taxes.Sanjiv Malhotra, Senior Advisor – Head of Tax Practice, Shardul Amarchand Mangaldas told TOI, “Few sectors wherein I will place my bets (for increased allocations) will be defense, hi-tech manufacturing and skill development.”Thus, these signals indicate that Budget 2026 will likely focus on targeted investments and fiscal prudence, aiming to sustain growth while strengthening strategic sectors.