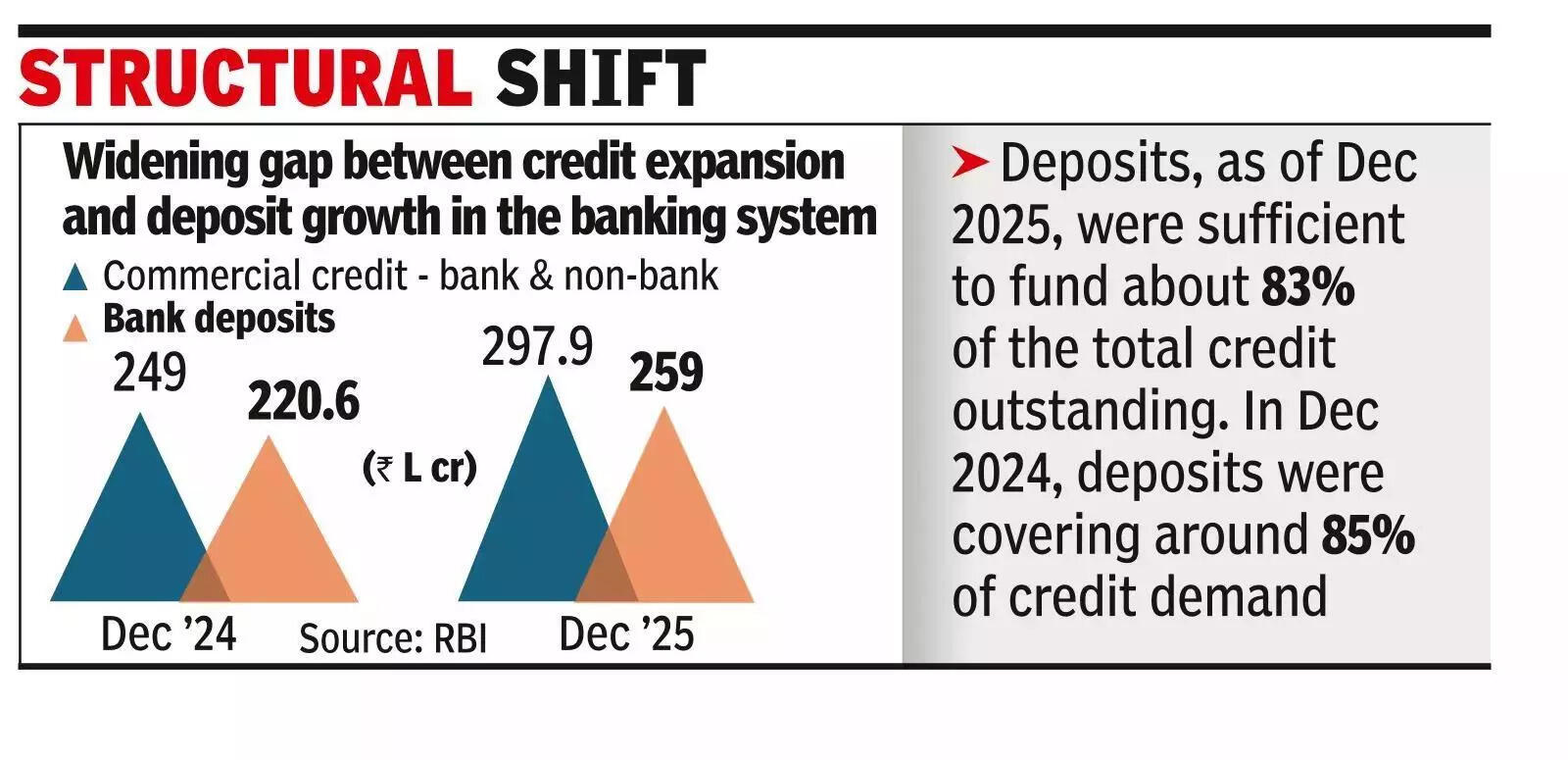

Bank depositors’ role in funding credit growth on decline: RBI data

MUMBAI: India’s bank depositor remains the predominant source of credit to the commercial sector, but their relative contribution is steadily declining as credit growth outpaces deposit mobilisation, data for Dec 2025 show.As of Dec 2025, total outstanding credit to the commercial sector (bank and non-bank) rose to Rs 297.9 lakh crore, while bank deposits stood at Rs 249 lakh crore. Deposits were sufficient to fund only about 83% of the total credit outstanding. A year earlier, in Dec 2024, bank deposits amounted to Rs 220.6 lakh crore against total credit of Rs 259.01 lakh crore, covering around 85% of credit demand. The data point to a widening gap between credit expansion and deposit growth in the banking system.

.

The trend reveals a structural shift in India’s credit landscape. Banks remain central to financing the commercial sector, but their deposit base is no longer keeping pace with the demand for credit. The growing reliance on NBFCs, bond markets and foreign borrowings reflects both deeper financial markets and mounting pressure on bank balance sheets as credit demand continues to surge.The first nine months of 2025-26 saw a sharp acceleration in credit flow to the commercial sector. While banks continue to anchor the system, the pace of credit creation has increasingly relied on non-bank channels.Non-food bank credit remained the single largest source of incremental funding. Between Dec 2024 and Dec 2025, bank credit expanded by Rs 25.5 lakh crore, accounting for 65.5% of the total increase in commercial sector credit. Outstanding non-food bank credit stood at Rs 202.3 lakh crore at end-Dec 2025, reflecting a year-on-year growth of 14.4%.