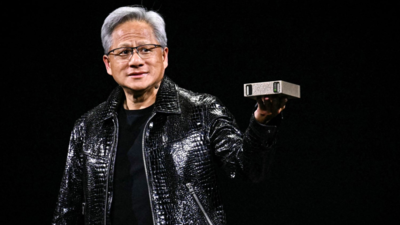

Nvidia CEO Jensen Huang’s net worth soars $1 billion as the chipmaker joins the $4 trillion club |

Nvidia finished trading on July 10 with a market value of just over $4 trillion, the first time any listed firm has crossed that threshold. The jump did more than rewrite Wall Street leaderboards; it also pushed co-founder and Chief Executive Jensen Huang’s fortune past $140 billion. He owns about 3.5 percent of Nvidia, held directly and through family trusts, so every flicker in the share price lands straight in his pocket.Bloomberg’s daily billionaire tally shows Huang adding roughly $1 billion in a single session, and nearly $28 billion in 2025 so far. That kind of lift puts him shoulder-to-shoulder with household names like Warren Buffett, a spot unthinkable just three years ago. Investors keep paying the premium because Nvidia sells the chips that make modern AI run, from data-centre clusters to enterprise servers. The faster the market grows, the richer Huang becomes.

Jensen Huang’s net worth passes $140 billion

As of the New York closing bell on 10 July, Bloomberg pegged Huang’s net worth at $143 billion, up from about $20 billion in early 2022. That leap happened in stages: $44 billion by mid-2023, $117 billion in late 2024, and now the $140-plus range. The difference this year alone is bigger than the entire market value of some Fortune 500 firms.

Nvidia’s market value climbs above $4 trillion

The company’s share price settled near $164, capping a run that has lifted the stock 74 percent since April’s low and around 22 percent since January. Nvidia is now the dominant weight in the S&P 500, ahead of Apple and Microsoft. Analysts at Citi, Barclays and Loop Capital all raised their price targets this week, citing demand for the upcoming Blackwell platform and a backlog of data-centre orders.

How a 3.5 percent stake fuels one of the world’s biggest fortunes

Huang’s percentage looks small beside founder holdings at some other tech giants, yet at a $4 trillion valuation it leaves him with shares worth roughly $140 billion. The stake figure comes from Nvidia’s March 2025 proxy filing and excludes unvested stock units. Cash, past dividend income and secondary-share sales round out the number Bloomberg uses, but the equity slice is what matters daily.

Where Jensen Huang now ranks among global billionaires

With the latest move, he edges into Bloomberg’s global top ten, swapping places with Google’s Larry Page and closing in on Warren Buffett. Forbes, which refreshes less often, lists him ninth. None of the other names in that bracket made their money so fast in so short a window.Why investors keep bidding the price up

- AI demand everywhere. Cloud providers, carmakers, and sovereign data-centre projects line up for the current Hopper chips and the coming Blackwell series.

- Scarcity premium. Nvidia controls around 80 percent of high-end AI GPU supply, and capacity stays tight even after Taiwan’s fabs ramp up output.

- Ecosystem lock-in. CUDA software and support contracts make switching costs high, so even rivals that launch competitive silicon must still lure developers away.

What could slow the rally

- Export curbs. The United States still blocks top-tier chips from shipping to China, Nvidia’s largest single-country market outside the U.S.

- New competition. AMD, Intel and a clutch of start-ups are readying chips that nibble at Nvidia’s margins, especially in inference workloads.

- Rich valuation. At about 40 times forward earnings, the stock leaves little room for an earnings miss; even a small disappointment could yank billions from Huang’s paper wealth.