Your bank locker may be sealed! Haven’t signed the updated locker rent agreement? Here’s what banks may do

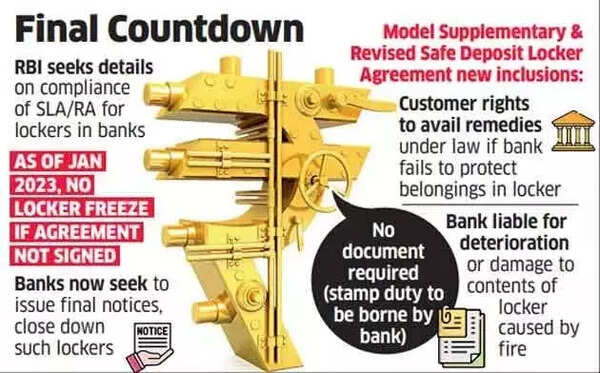

Have you signed the updated locker agreement with your bank? If not, you are at the risk of losing your locker. Customers who have bank lockers face the risk of losing access if they fail to sign a revised rental agreement with their banks. Approximately 20% of locker renters could be denied access for not meeting regulatory timelines.The revised locker agreement now includes provisions allowing customers to seek legal remedies if banks fail to safeguard their locker contents.Banks are considering measures against non-compliant customers as the Reserve Bank of India (RBI) monitors compliance levels. Sources told ET that banks have approached both the regulator and government officials seeking authorisation to dispatch final notices and potentially seal lockers. These actions aim to ensure adherence to regulations whilst protecting banks from supervisory concerns.

Bank Locker Agreement

Currently, banks limit their actions to sending reminder notices to customers about agreement renewals. A government representative confirmed that they are reviewing the appeal from public sector banks.The RBI’s updated guidelines for locker agreements required complete implementation by March 2024. In August 2021, RBI instructed banks to implement revised agreements with existing locker holders by January 1, 2023, considering technological advancements, customer complaints and feedback.Subsequently, RBI extended the implementation deadline to December 2023, followed by a further extension to March 2024.Also Read | ITR filing FY 2024-25: Do you need to file your income tax return if TDS has been deducted? Explained“There are customers who, despite reminders, have not turned up…. Then there are some genuine cases due to legal issues between parties involved,” said a bank executive.During discussions with the RBI, banks have requested permission to suspend locker operations and issue notices when customers fail to comply, according to another banking official.“Meanwhile, we have requested that the compliance date of March 2024 should be extended, including the time given to the customer for compliance, which can be four months,” said the banker cited immediately above. The banker suggested December 2025 as the new deadline for banks to achieve full compliance with RBI regulations.Also Read | Big e-Aadhaar revamp on the cards! No more photocopies of Aadhaar card required, updation to become easy; check top steps