Tether Buying Gold: ‘James Bond-style’ bunker: Why a crypto firm is buying more gold than most central banks

Gold is not just another metal. For centuries, the yellow metal has been a symbol of safety and stability, serving as a reliable hedge when markets turn volatile. Centuries ago, kings hoarded it to display their power, then, as nations modernised, central banks began stockpiling gold to shield their economies against crises. But recently, gold has found a surprising admirer. One of its biggest buyers is no longer a country or royal treasury, instead, a private crypto giant, Tether. The crypto giant is quietly changing the old gold rush, biting off a huge chunk of global demand for itself. Tether Holdings SA has stored its gold like a secret agent, hidden deep inside a “James Bond”– style nuclear bunker in a Swiss mountain, Tether CEO Paolo Ardoino told Bloomberg. Now while that is already beginning to sound huge, what’s more staggering is the scale — the company is now scooping up more gold than entire countries like Kazakhstan, China, and a few others. Each week, the company has been sweeping up almost two tonnes!Tether, world’s largest crypto company, is a digital platform launched in 2014, designed to use traditional money on the blockchain. Tether tokens are a type of stablecoins designed to stay non-volatile as the value of each token is tied to a real currency. For example, 1 USD₮ are said to equal 1 US dollar. Furthermore, according to the company’s website, all Tether tokens are fully backed by real reserves. Currently, $187 billion worth of Tether’s USDT tokens are in circulation.The company also offers Tether Gold (XAU₮), a digital token that it claims represents real physical gold.

Tether’s golden obsession

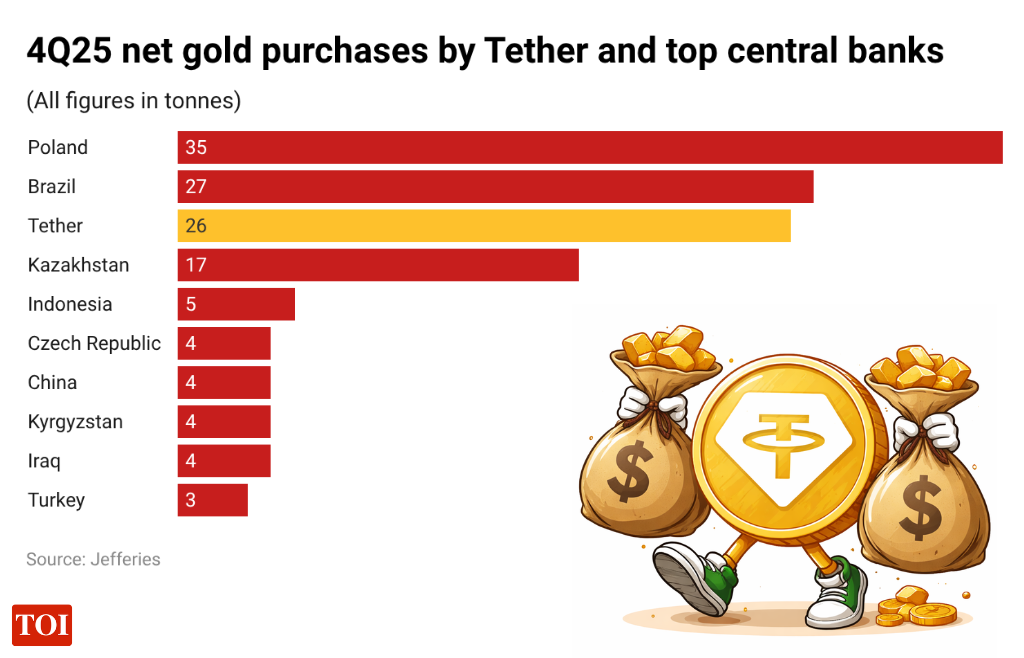

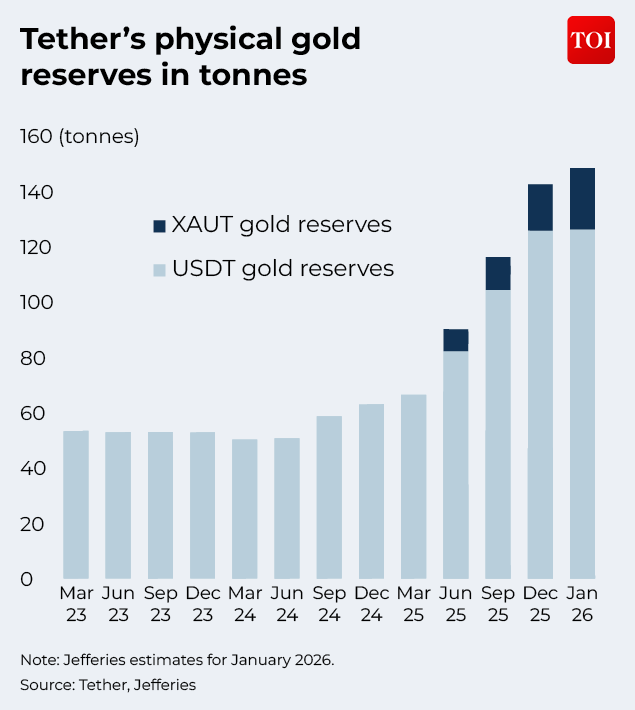

The crypto giant is emerging as the largest private buyer of physical gold with its staggering purchases and monthly supplies. In an interview with Bloomberg, Ardoino said Tether’s rapidly growing gold holdings now resemble the scale of reserves typically maintained by central banks.The numbers show how fast this shift is happening. By the end of 2025, Tether held 142 tonnes of gold worth nearly $20 billion. By the end of January 2026, the figure rose to around 148 tonnes, valued at more than $23 billion. In the final quarter of 2025 alone, it bought 26 tonnes, followed by another 6 tonnes in January, according to Jefferies.These numbers are huge, but the scale becomes even larger when you take a closer look.Tether is now buying more gold than many central banks with only Poland and Brazil surpassing the crypto giant in the last quarter. That means a private crypto company ranks among the top three gold buyers in the world, ahead of almost every nation, according to the report.

Furthermore, Tether’s gold purchases of 26 tonnes in 4Q25 were equivalent to 11.4% of total central bank gold demand of 230 tonnes last quarter. In other words, more than one-tenth of official sector gold demand last quarter came from a single private company.

$5 billion added to valuation

Tether has emerged as one of the major winners from this year’s sharp rally in gold, reporting gains of more than $5 billion on its bullion holdings.The crypto heavyweight saw the value of its gold reserves jump last month as bullion prices continued their strong upward run. With gold climbing above $5,200 an ounce, the firm’s stockpile of the precious metal has appreciated by over $5 billion.According to the Financial Times, the company held about 116 tonnes of gold at the end of September. At that point, the hoard was valued at roughly $14.4 billion.Since then, gold prices have risen from around $3,858 per troy ounce to above $5,200, significantly boosting the paper value of Tether’s reserves.

Why is the stablecoin issuer buying gold?

But, the real question is, why is a crypto currency firm buying gold? The answer lies in a mix of strategy, survival, and ambition.Tether Gold: A key factor behind this trend is Tether Gold (XAU₮). Each XAU₮ token is said to be backed by one troy ounce of real gold. Because the token maintains a 1:1 backing, rising demand for tokenised gold requires Tether to continually purchase and store additional physical bullion. By early 2026, the tokenised gold market had grown beyond $6 billion in total value, with XAU₮ accounting for over 60% of the segment. In economies that are under constant inflation pressures, including Turkey, Argentina and Nigeria, many investors are turning towards digital gold tokens as an alternative to weakening local currencies. This shift in investor behaviour directly translates into higher physical gold purchases and expanded vault holdings for Tether.Gold engine fueling Tether: The firm reported net profits of more than $10 billion in the first nine months, pushing its valuation to around $500 billion and placing it in the same league as OpenAI, according to Binance Square. A major share of earnings comes from steady interest generated on roughly $135 billion invested in US Treasuries, estimated to bring in about $4 billion annually at a 4% yield. Gold, however, stands out as a particularly powerful profit driver. For instance, when the yellow metal’s prices jumped from about $2,624 per ounce at the start of 2025 to $3,859 by September 30, a surge of 47%, Tether’s $5.3 billion gold holdings at the end of 2024 delivered a major windfall. This stock of “old gold” alone generated roughly $2.5 billion in unrealised gains.When combined with fresh purchases made during 2025, gold appreciation is estimated to account for $3–4 billion of Tether’s multi-billion-dollar profit haul, making it one of the company’s most significant earnings boosters.Safety net: Tether has been allocating a portion of its profits to build up gold reserves and expand its presence in the gold sector as a hedge against potential depreciation of US bonds and the risk of interest rate cuts. By steadily accumulating both gold and Bitcoin, the company has strengthened its reserve position, reinforcing confidence and brand value in the stablecoin market and supporting the issuance of additional stablecoins.

Diversifying portfolio: Much like investors, Tether is also diversifying its portfolio. The company’s core product is USDT, a dollar-pegged stablecoin widely used across global crypto markets and primarily backed by US Treasuries, with total exposure exceeding $140 billion as of 2026. However, it has been steadily expanding its reserves beyond traditional “paper” assets.Ardoino told Reuters that the company is planning to allocate 10%–15% of its investment portfolio to physical gold, adding to the bullion that already backs some of its products.Investing profits from risk free interests: Amid the Federal Reserve’s high interest rate cycle, Tether has been earning billions in largely “risk-free” interest from its US Treasury holdings, reporting a net profit of $4.9 billion in the second quarter of 2025 alone.The company is sourcing a part of these profits to accumulate gold and broader positioning in the gold sector to hedge against potential US bond depreciation or future rate cuts.

The bigger picture

For decades, global gold demand was largely shaped by central banks, jewellers and commodity investors.But that is gradually changing.Over time, private institutions, sovereign wealth funds, stablecoin issuers and corporate treasuries also joined the queue for gold purchasing. Rising geopolitical tensions and currency volatility are pushing these players to seek safer, harder assets.Stablecoin issuers, in particular, are purchasing gold in volumes once typical of medium-sized central banks. At the same time, big tech firms and investment funds are adding bullion to diversify their portfolios.The result? Non-state buyers are becoming a powerful and fast-growing force, reshaping the global gold demand landscape. The purchases are not just adding gold to their vaults, but the impact also spills across global markets. On a year-on-year basis, gold prices have skyrocketed over 90% year-over-year. Tether plans to keep buying the yellow metal at the current pace for at least the next few months, which would mean over $1 billion in purchases each month at prevailing prices.