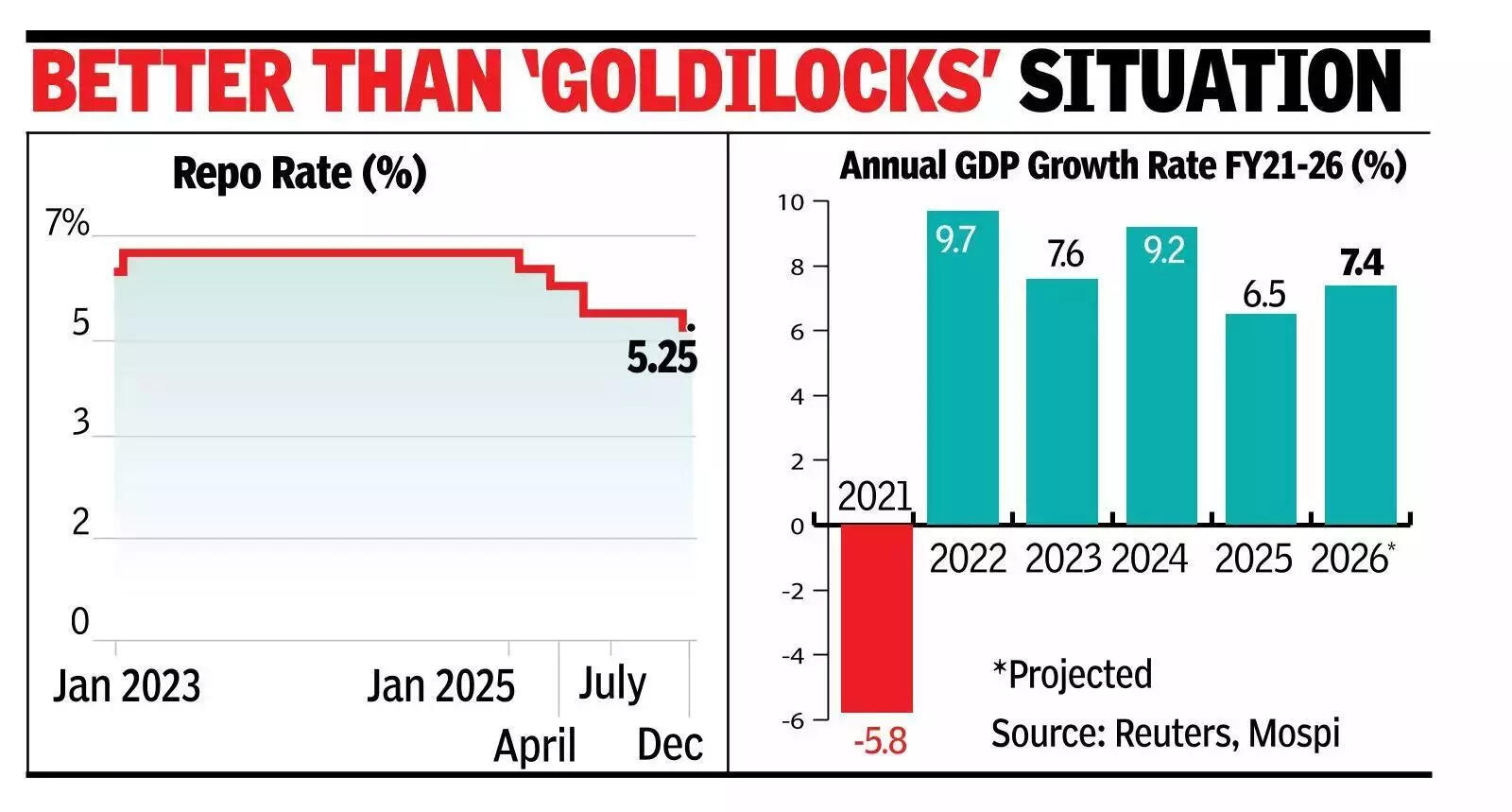

GDP growth outlook raised to 7.4%, repo rate stays at 5.25%

MUMBAI: RBI on Friday raised India’s GDP growth rate projections for the current fiscal to 7.4% from 7.3% earlier, while the central bank’s monetary policy committee (MPC) left the repo rate unchanged at 5.25%. The MPC also decided to continue with its neutral stance, a release from RBI said.RBI governor Sanjay Malhotra said that the economic growth rate was better than what it was earlier while inflation was benign, a situation that he had, in Dec 2025, described as a ‘goldilocks situation’ for India.

“We are in a better position than (in Dec 2025). Growth seems to be better than earlier… inflation is the same. Headline inflation may be a few basis points here and there… it is a very small number,” Malhotra said during the post-policy media meet. “India’s macroeconomic fundamentals are very strong. Growth, inflation, current account and capital flows are all in a healthy position.”

The RBI also revised GDP growth projections for the April-June and July-September 2026-27 periods to 6.9% and 7%, respectively.“Going forward, economic activity is expected to hold up well in 2026-27. Agricultural activity will be supported by healthy reservoir levels, robust rabi sowing, and improvement in crop vegetation conditions,” RBI said. “Improving corporate sector performance and sustained momentum in informal sector should boost manufacturing activity. Construction sector growth is expected to remain firm. Services sector should continue to be resilient, with strengthening domestic demand.”On the demand side, the central bank said that the momentum in private consumption is expected to sustain in 2026-27. “Rural demand remains steady, with improving agricultural activity and rural labour market conditions. Recovery in urban consumption should further strengthen with continued support from GST rationalisation and monetary easing. High-capacity utilisation, accelerating bank credit, conducive financial conditions, and govt’s continued emphasis on infrastructure should give an impetus to investment activity.“