Budget 2026 income tax: Will GST-style fewer tax slabs be brought under new income tax regime?

Budget 2026 income tax expectations: Taxpayers in India are looking at Finance Minister Nirmala Sitharaman’s speech for announcements related to simplification of income tax slabs, returns, compliance and more. India has two personal tax regimes: old and new, with the latter being the default tax regime that the government is pushing people to adopt. The old income tax regime has fewer tax slabs, and offers more deductions and exemptions. On the other hand, the new income tax regime has the benefit of lower tax rates, higher levels of income at which higher tax rates kick in, but very few deductions and exemptions.Tax experts believe that while the new income tax regime reduces the tax outgo for many taxpayers, the multiple slabs add to confusion. They recommend an approach similar to the one used for GST rates rationalization to make the personal tax regime more friendly for taxpayers.

New GST Slabs

Last year, the government slashed the Goods and Services Tax (GST) on several commodities and reduced the tax slabs to broadly two categories – 5% and 18%. Will something similar be announced for the new income tax regime this Budget?

What Are The Current Income Tax Slabs?

The new income tax regime was introduced in Union Budget 2020 and has since then evolved with lower tax rates, progressive tax slabs and higher rebates. Last year, FM Nirmala Sitharaman made income up to Rs 12 lakh tax free – a limit that goes up to Rs 12.75 lakh for salaried taxpayers with the inclusion of standard deduction benefits.

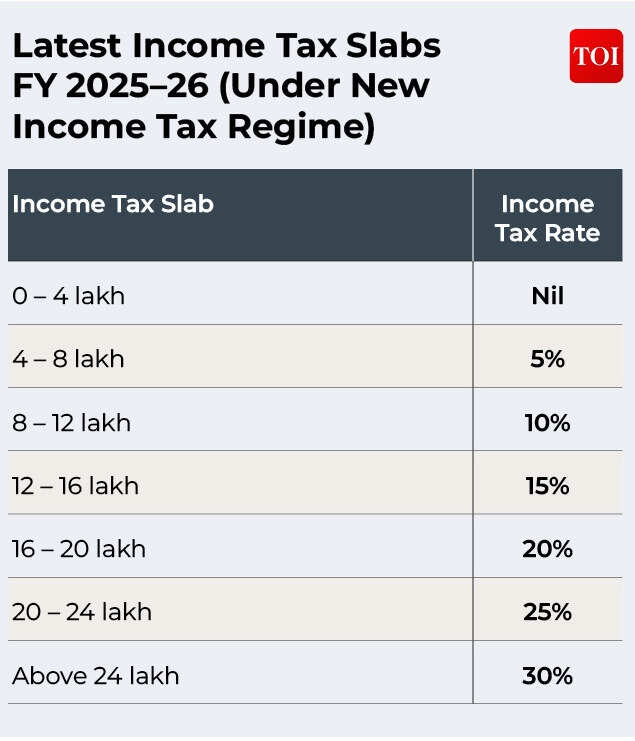

Latest Income Tax Slabs FY 2025–26 (Under New Income Tax Regime)

At present the new income tax regime has as many as seven tax slabs – a fact that makes it somewhat confusing for taxpayers. The new tax regime has multiple slabs starting with a nil rate and then moving through 5%, 10%, 15%, 20%, 25% and 30% across different income levels.

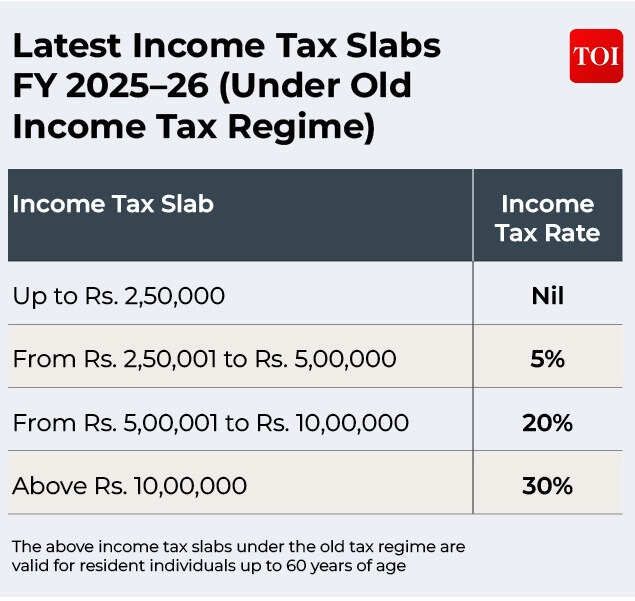

Latest Income Tax Slabs FY 2025–26 (Under Old Income Tax Regime)

The old income tax regime continues, largely unchanged for the last few years, as the government looks to step up adoption of the new income tax regime. Tax experts widely believe that any changes to the tax regime will now be made under the new income tax regime. But, is there a case to reduce the number of income tax slabs?

Should Number Of Income Tax Slabs Be Reduced?

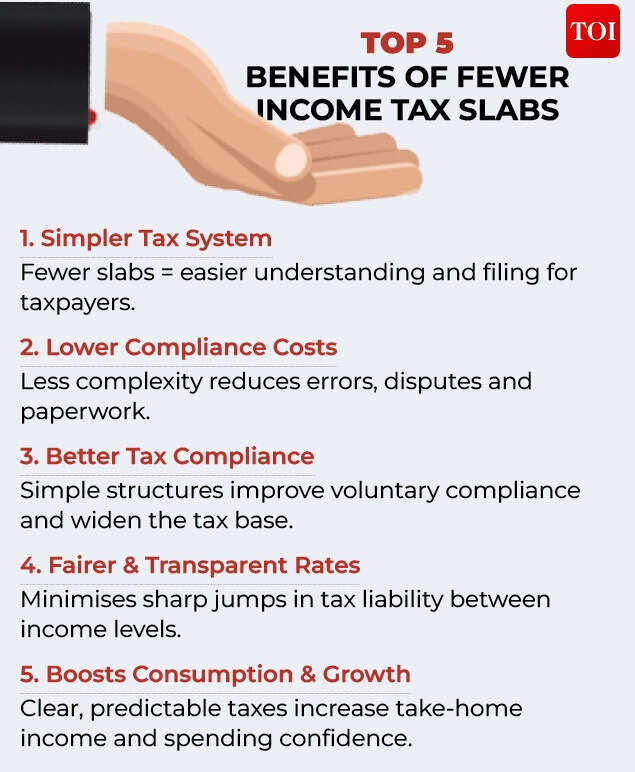

Tax experts surveyed by Times of India Online are broadly of the view that there is a need for more simplification of the income tax slabs and rates, for a more streamlined and compliance friendly regime. While experts acknowledge that an immediate change in tax slabs may not be possible, given limited fiscal room after last year’s big changes and GST rate cuts, they suggest a progressive move towards a simplified personal tax regime.Surabhi Marwah, Tax Partner at EY India explains that two major changes in the recent past, which include the alignment of the GST structure and revamp of the Income-tax Act, show the government’s clear intention to simplify India’s tax framework. Along with the reforms in GST, the introduction of the Income-tax Act 2025 also reflects this commitment to creating a cleaner and more streamlined regime, as it reduces the number of sections from 819 to 536 and cuts the word count nearly by half, from 5.12 lakh to 2.60 lakh, Surabhi Marwah tells TOI.“Extending this philosophy to personal income tax, rationalising the slab structures into fewer and broader slabs would enhance clarity, reduce litigation, and make compliance easier for taxpayers,” she recommends.

Top 5 Benefits of Fewer Income Tax Slabs

Radhika Viswanathan, Executive Director at Deloitte India feels that there is a strong case for simplifying personal income tax slabs, given the complex multi-rate structure and rising compliance challenges. Why the need? Viswanathan explains that a streamlined 2-3 slab structure, potentially with a single regime and bigger gaps in slabs and rates, could enhance compliance, reduce litigation, and mirror GST’s success. Some tax experts cite global benchmarks and examples to advocate for an income tax regime with fewer tax slabs. Others point to multiple slab tax structures in developed countries.Preeti Sharma, Partner – Tax and Regulatory Services at BDO India notes that while the current income tax slabs structure is progressive, many taxpayers still find it complex.“In many countries, personal income tax systems follow a simpler structure with just three or four slabs such as Denmark, Netherlands. India could gradually move in that direction as well. The experience of GST is often cited in this context, where multiple indirect taxes were replaced with a limited number of tax slabs to simplify the system,” she tells TOI.Parizad Sirwalla, Partner and Head, Global Mobility Services, Tax at KPMG in India says that simplification of tax regime has been the stated intent of the government when they had first introduced the new optional tax regime almost five years back.“However, considering various other factors (e.g. inflation, job creation, fiscal deficit etc.) this transition may take time. Further for a country like India – the varied income distribution does make a case for multiple slab structures. Also, internationally many developed countries (e.g., US, UK, Germany etc.) have a multiple slab rate structure,” she says.Chander Talreja, Partner at Vialto Partners believes that the 2-3 slab structure for the new tax regime may not be introduced as it already provides simplified tax slabs. “There are 7 income levels with clearly defined applicable tax rates. The rationale of the said slab rates is to ensure lower tax burden for the individual taxpayers unlike the old regime wherein it is just 4 slabs,” he tells TOI.“For example – the effective tax rate applicable for income falling in tax slab Rs 12-16 lakh under the new tax regime is 15% whereas it is 30% under the old regime. Similarly, the effective tax rate applicable for income of Rs 9 lakh under new tax regime is NIL whereas it is 20% under the old regime,” he explains.

Will Budget 2026 Bring Fewer Income Tax Slabs?

Tax experts who spoke to Times of India Online were unanimous in saying that the government does not have immediate room to reduce the number, though the road ahead should be in that direction?Radhika Viswanathan of Deloitte India says that to achieve a 2-3 tax slab structure, the market has to be much more mature. “There has to be a bit of parity between the tax collections at the government level and good purchasing power in the hands of the individuals. Given the tweaking done in last year’s budget, such a simplification might be on the cards, but perhaps not immediately,” she says.Richa Sawhney, Partner, Tax at Grant Thornton Bharat admits that the introduction of 2-3 slab structure for personal income tax will surely simplify the personal taxation regime and make tax calculations easier. “It also aligns with the government policy of simplification of taxation laws and easing compliance,” she tells TOI.But Richa Sawhney is of the view that doing that in the immediate future may not be feasible for the government. “With changes in the direct tax provisions last year, which included the changes in slab rates, the government had anticipated a revenue forgone figure of Rs 1 lakh crore. The latest data on revenue shared by the government shows a near‑flat gross non‑corporate tax collection. So significant change may not be forthcoming in this year’s budget,” she tells TOI.Some tax experts suggest that the government may look to eventually transition to a personal income tax regime that has fewer slabs. “The recent budgets have focused on adjusting rates and income thresholds rather than making structural changes. As a result, a full move to a 2–3 slab personal income tax system may not happen immediately, but the government may gradually reduce the tax slabs over a period of time,” Preeti Sharma of BDO says.Tanu Gupta, Partner at Mainstay Tax Advisors LLP points out that in an exemption-light regime, it is particularly important to maintain progressivity in tax incidence, especially in the Indian context where equity and ability-to-pay considerations are central to tax policy.At the same time, a simplified slab structure—such as a two- or three-slab framework—can significantly improve transparency, ease of understanding, and voluntary compliance, much like the government’s approach in streamlining the GST rate structure recently, she tells TOI.“Accordingly, the government must strike the right balance between simplicity and fairness by combining a streamlined slab structure with a rate design that remains equitable and just. In doing so, it is essential to ensure that taxpayers are not placed in an adverse position, such as paying higher tax on the same income level compared to the previous year,” she concludes.