India-EU FTA nears completion: How ‘mother of all trade deals’ can offer gains amid Trump’s tariff uncertainty – explained

In a historic first, India and the European Union are all set to seal a trade deal that has taken almost two decades to finalize. The scale of the proposed free trade agreement is evident in Commerce Minister Piyush Goyal’s description of the FTA – he has called it the ‘mother of all deals’. “I have done seven deals so far. All with developed economies. This one will be the mother of all,” Goyal said a few days ago.India and the European Union are on the verge of sealing their long-delayed free trade agreement, with negotiations entering the final stretch after almost 18 years. A formal signing of the trade deal is expected around January 26–27, when senior EU leaders visit India. The trade deal is likely to be announced at the 16th India–EU Summit in New Delhi. The agreement is now officially termed the India–EU Free Trade Agreement, replacing the earlier Broad-based Trade and Investment Agreement label that had been in use since talks began in 2007.

India-EU trade dynamics

If concluded, the India–EU FTA would mark India’s ninth trade agreement in the past four years, adding to a growing list that includes deals with Mauritius, the UAE, Australia, New Zealand, Oman, the EFTA bloc, the UK, and partners under the Indo-Pacific Economic Framework.

India-EU Free Trade Agreement – What’s in it for India?

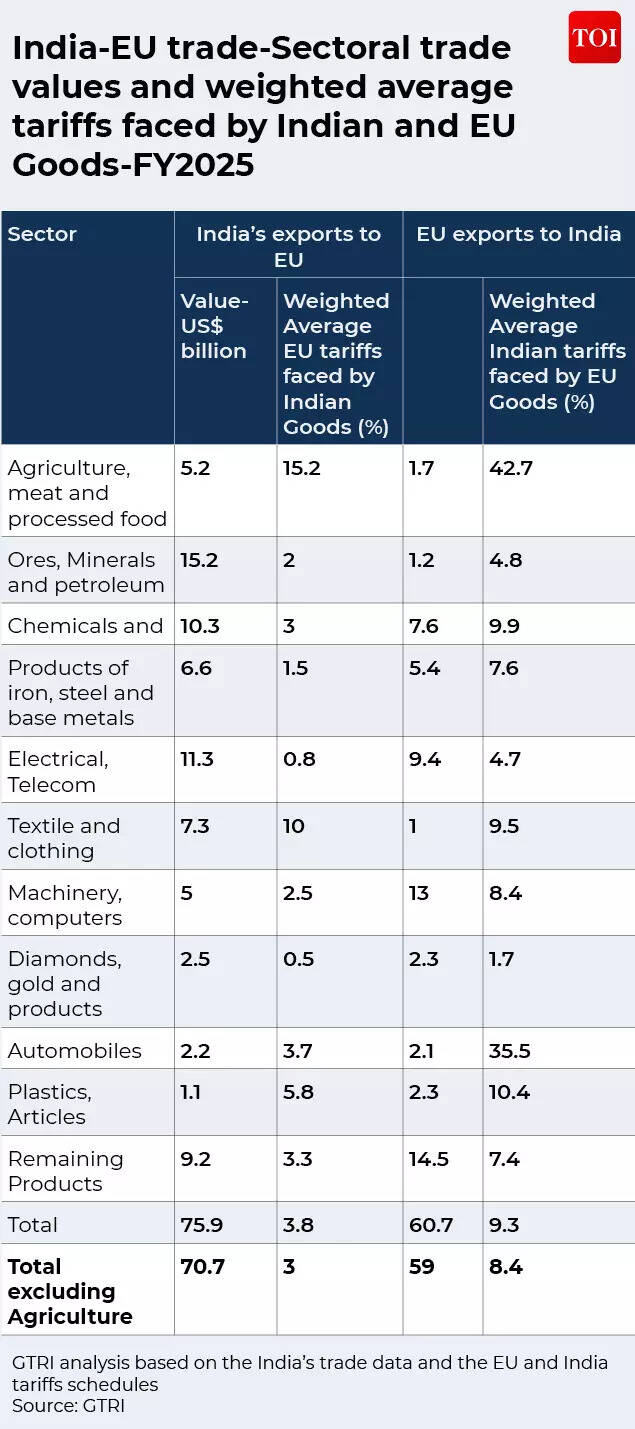

Once finalised, the pact would become India’s largest free trade agreement in terms of both economic scale and regulatory coverage. It would offer preferential access to all 27 EU member states through a single framework, as the EU functions as a customs union.According to an analysis by the Global Trade Research Initiative (GTRI), for India, the proposed agreement opens the door to one of the world’s most affluent and reliable economic blocs, the European Union, whose GDP is estimated at €18–22 trillion and whose market spans around 450 million high-income consumers. GTRI notes an important point: The India–EU free trade agreement is close to completion not because long-standing differences have vanished, but because shifting geopolitical realities have compelled both sides to adopt a more pragmatic approach. The agreement holds particular significance for its timing, considering the trade war unleashed by US President Donald Trump. While the EU is now faced with fresh 10% tariffs from the US, which could go up to 25%, India has already been hit by 50% tariffs on its exports to America.In FY2025, India exported goods worth about $76 billion to the EU and imported roughly $61 billion, resulting in a trade surplus. However, the withdrawal of the EU’s Generalised System of Preferences in 2023 weakened the competitiveness of several Indian exports. The average EU tariffs on Indian goods is already relatively modest – at around 3.8 percent on exports of $75.9 billion in FY2025. However, labour-intensive sectors such as textiles and apparel continue to face duties of close to 10 percent. “Removing these tariffs would deliver clear export gains. An FTA would restore lost market access, lower tariffs on key exports such as garments, pharmaceuticals, steel, petroleum products and machinery, and help Indian firms better absorb shocks from higher U.S. tariffs,” says GTRI founder Ajay Srivastava.Just as importantly, expanded market opening in services, particularly in IT and other skill-driven segments, would allow India to capitalize on its large talent base, grow services exports to Europe, and lessen its reliance on the U.S. market.Negotiations on the India–EU Free Trade Agreement span a wide and complex agenda, with goods and services at the core of unresolved differences. The EU is pressing India to eliminate tariffs on over 95% of imports, while New Delhi is willing to go closer to 90%, keeping agriculture and dairy out of scope. At the same time, India stands to gain significantly from improved access for labour-intensive exports such as textiles, garments, leather and auto components, which currently face higher EU tariffs than competitors.

India’s Goods Exports to EU

In services, India is pushing back against EU requirements for local presence, high salary thresholds and restrictions on remote delivery, while seeking data adequacy status, easier visas, social security coordination and recognition of qualifications. The EU, in turn, is demanding greater access to India’s financial, legal and banking sectors, alongside commitments on data protection.Resolving the Carbon Border Adjustment Mechanism (CBAM) issue is a priority for India since it threatens to dilute the gains from any tariff reduction. The EU’s Carbon Border Adjustment Mechanism, which is already applicable to products such as steel and aluminium, effectively imposes an additional charge on Indian exports even if customs duties are done away with under the FTA. This impact is particularly severe for MSMEs, since they face high compliance costs, complex disclosure obligations and the risk of penalties based on default emissions values that may overstate actual carbon intensity. Beyond tariffs, Indian exporters encounter an extensive range of non-tariff barriers in the EU that often erode the benefits of market opening. These include delays in pharmaceutical approvals, strict sanitary and phytosanitary requirements affecting food and agricultural exports such as buffalo meat, and intricate testing, certification and conformity-assessment procedures. Agricultural products like basmati rice, spices and tea are frequently rejected or subjected to intensified inspections following sharp reductions in permissible pesticide residue limits, while seafood exports face higher sampling rates due to concerns over antibiotic use.

How will the European Union Benefit?

GTRI notes that for the European Union, a trade pact with India offers access to scale, growth and sustained demand that are increasingly scarce within Europe. India, with an economy of about $4.2 trillion and a population of 1.4 billion, is among the fastest-growing major economies globally, yet remains shielded by relatively high tariff and regulatory barriers. European exports to India face significantly steeper obstacles, with a weighted average tariff of roughly 9.3 percent on shipments worth $60.7 billion. Certain sectors see particularly heavy duties, including automobiles and components at about 35.5 percent, plastics at 10.4 percent, and chemicals and pharmaceuticals at around 9.9 percent, all of which raise entry costs for EU firms.

India’s Goods Imports From EU

Lowering these barriers would substantially improve market access. An FTA would create sizable opportunities for European exporters in areas such as aircraft, machinery, chemicals and other high-value manufactured products, while also broadening access in services, public procurement and investment. Beyond trade, deeper economic engagement with India supports the EU’s strategic aim of diversifying supply chains, cutting excessive dependence on China, and establishing a long-term economic and geopolitical foothold in one of Asia’s fastest-growing large economies.

Conclusion

According to GTRI, the India–EU FTA has the potential to reshape India’s trade relationship with Europe and anchor long-term export growth, investment flows, and supply-chain integration. “It offers clear gains in goods trade, especially for labour-intensive sectors in a world of rising protectionism. At the same time, unresolved issues – most notably CBAM, services mobility, and non-tariff barriers – pose significant risks of imbalance,” it says.“Whether the agreement ultimately becomes a growth-enabling partnership or a strategically asymmetric deal will depend on how these final issues are resolved,” it concludes.